Navigating the Future: Exploring 30 Year Fixed Rate Mortgage Trends in 2025

Related Articles: Navigating the Future: Exploring 30 Year Fixed Rate Mortgage Trends in 2025

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Future: Exploring 30 Year Fixed Rate Mortgage Trends in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Future: Exploring 30 Year Fixed Rate Mortgage Trends in 2025

The housing market is a dynamic ecosystem, constantly influenced by economic fluctuations, government policies, and evolving consumer preferences. As we look towards 2025, understanding the trends shaping the landscape of 30 year fixed rate mortgages becomes crucial for both prospective homeowners and investors. This article delves into the factors driving these trends, analyzing their potential impact and offering insights for navigating the mortgage market in the years to come.

The Underlying Forces Shaping Mortgage Trends:

Several key factors will contribute to the trajectory of 30 year fixed rate mortgages in 2025. These include:

- Federal Reserve Policy: The Federal Reserve’s monetary policy plays a pivotal role in influencing interest rates. As the Fed adjusts its target for the federal funds rate, it directly impacts the cost of borrowing, including mortgage rates. In 2025, the Fed’s actions will be driven by inflation, economic growth, and the overall health of the financial system. If inflation remains elevated, the Fed may continue to raise interest rates, potentially pushing 30 year fixed rate mortgages higher. However, if inflation subsides and the economy shows signs of slowing, the Fed may adopt a more accommodative stance, potentially leading to lower mortgage rates.

- Inflation: Inflation is a primary driver of interest rate movements. When inflation is high, lenders demand higher interest rates to compensate for the erosion of the value of their money. Conversely, when inflation is low, interest rates tend to be lower. The trajectory of inflation in the coming years will have a significant impact on 30 year fixed rate mortgages.

- Economic Growth: A strong economy generally supports a healthy housing market. When economic growth is robust, employment is high, and consumer confidence is strong, demand for housing increases, potentially driving up prices and pushing 30 year fixed rate mortgages higher. Conversely, a slowing economy can lead to decreased demand for housing, potentially putting downward pressure on prices and mortgage rates.

- Government Policies: Government policies, such as tax incentives for homeownership, regulations on mortgage lending, and housing subsidies, can directly influence the affordability and availability of mortgages. Changes in these policies can impact the supply and demand dynamics of the housing market, ultimately affecting 30 year fixed rate mortgages.

- Supply and Demand: The fundamental forces of supply and demand play a crucial role in shaping the housing market. When the supply of available homes is low and demand is high, prices tend to rise, potentially putting upward pressure on 30 year fixed rate mortgages. Conversely, a surplus of available homes can lead to lower prices and potentially lower mortgage rates.

- Technological Advancements: The rise of fintech and digital lending platforms is revolutionizing the mortgage industry. These platforms offer faster, more efficient, and often less expensive mortgage options, potentially increasing competition and impacting the pricing of 30 year fixed rate mortgages.

Exploring the Potential Scenarios for 30 Year Fixed Rate Mortgages in 2025:

While predicting the future with absolute certainty is impossible, considering various scenarios can provide valuable insights.

Scenario 1: Stable Interest Rates and Moderate Growth:

This scenario envisions a relatively stable economic environment with moderate inflation and steady economic growth. The Federal Reserve may maintain a neutral stance on interest rates, keeping 30 year fixed rate mortgages within a range similar to current levels. This scenario could benefit both buyers and sellers in the housing market, fostering a balanced and sustainable environment.

Scenario 2: Rising Interest Rates and Slowing Growth:

This scenario anticipates higher inflation and a potential slowdown in economic growth. The Federal Reserve may respond by raising interest rates to curb inflation, leading to higher 30 year fixed rate mortgages. This scenario could make homeownership less affordable for some buyers, potentially slowing down the housing market.

Scenario 3: Lower Interest Rates and Strong Growth:

This scenario envisions a favorable economic environment with low inflation and robust economic growth. The Federal Reserve may adopt a more accommodative stance, potentially lowering interest rates and making 30 year fixed rate mortgages more accessible. This scenario could lead to increased demand for housing and potentially higher home prices.

Navigating the Uncertainties:

Regardless of the specific scenario that unfolds, understanding the factors driving 30 year fixed rate mortgage trends is crucial for making informed decisions. Here are some key considerations:

- Financial Planning: Carefully assess your financial situation, including income, expenses, and debt levels. Determine your affordability threshold and consider the potential impact of rising interest rates on your monthly mortgage payments.

- Market Research: Stay informed about the latest trends in the housing market, including interest rate movements, inventory levels, and home price fluctuations. This information can help you make informed decisions about buying or selling a home.

- Consult with a Financial Advisor: Seek professional guidance from a financial advisor or mortgage broker to discuss your financial goals and explore different mortgage options that align with your needs.

- Consider Alternative Financing Options: Explore alternative mortgage products, such as adjustable-rate mortgages (ARMs) or FHA loans, which may offer lower interest rates initially but come with different risk profiles.

Related Searches:

The search for information about 30 year fixed rate mortgages often extends beyond the basic trends. Here’s a breakdown of some common related searches and their relevance:

1. 30 Year Fixed Rate Mortgage Forecast:

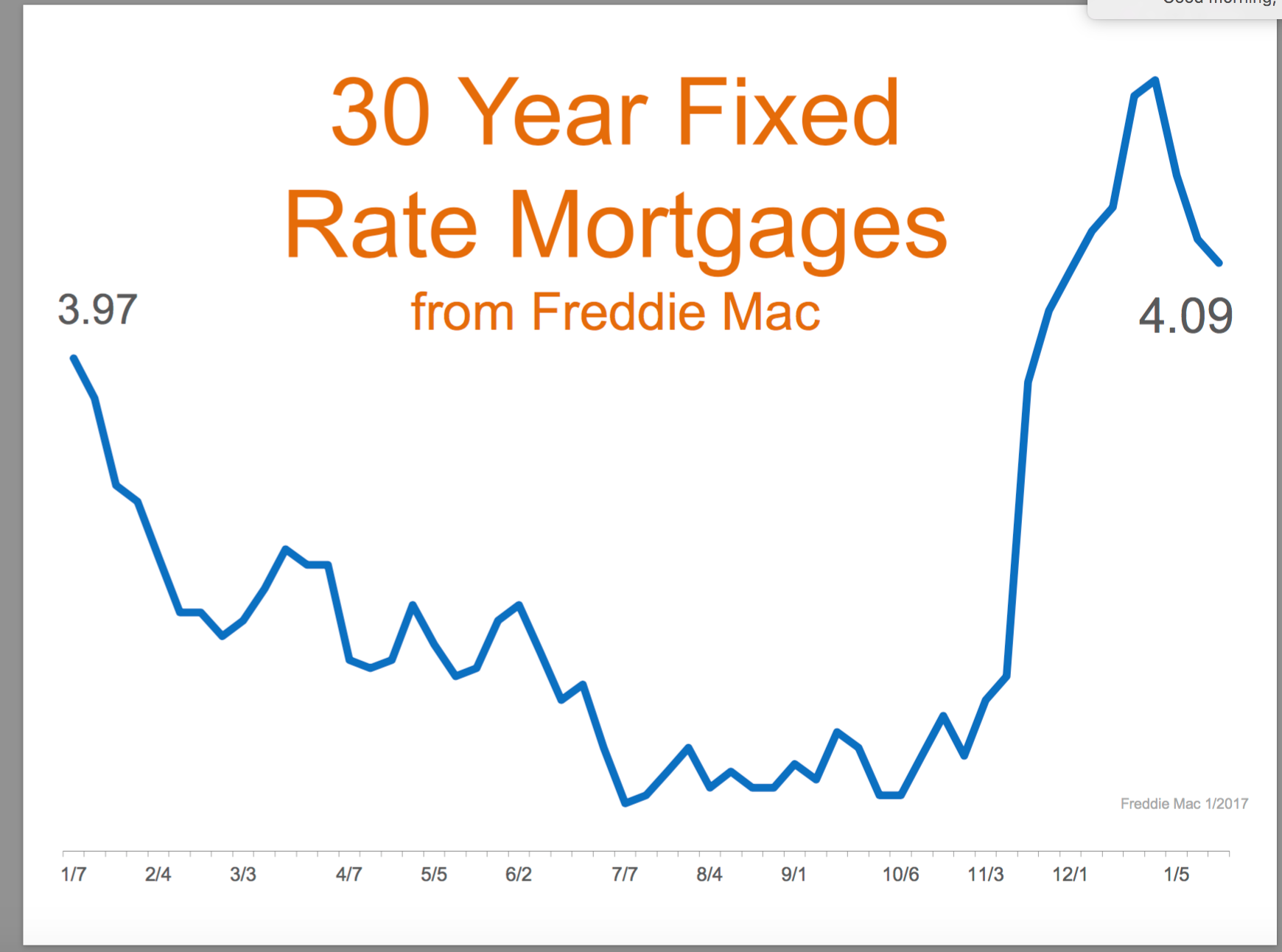

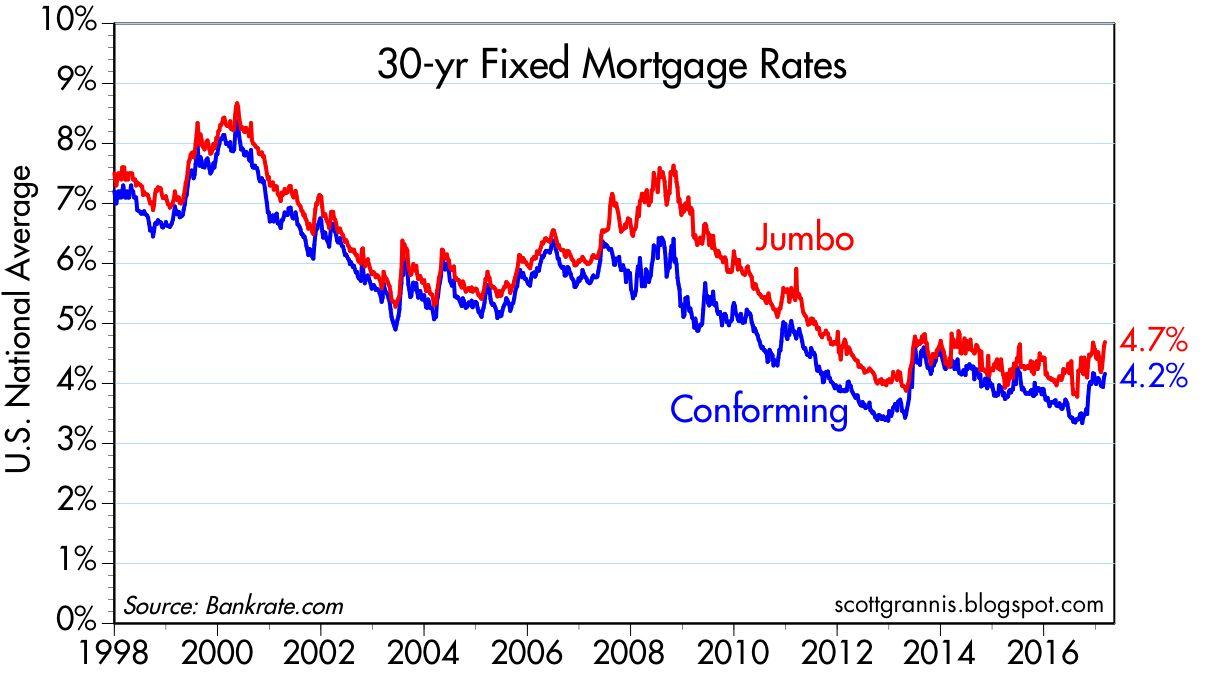

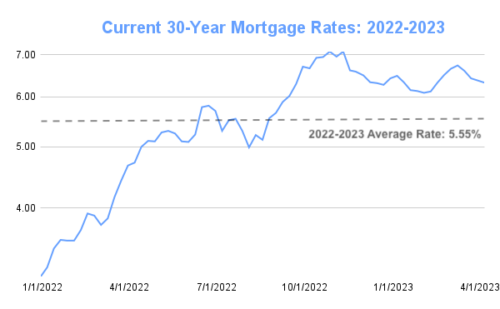

This search reflects the desire to understand the future trajectory of interest rates and their potential impact on mortgage payments. Analyzing historical data, economic indicators, and expert predictions can provide insights into potential rate movements.

2. 30 Year Fixed Rate Mortgage Calculator:

This search highlights the practical need to estimate monthly mortgage payments based on various loan amounts, interest rates, and loan terms. Mortgage calculators are valuable tools for understanding the financial implications of different mortgage options.

3. Average 30 Year Fixed Rate Mortgage:

This search focuses on understanding the current market average for 30 year fixed rate mortgages. Tracking average rates provides context for comparing different lenders and offers a benchmark for assessing individual mortgage rates.

4. 30 Year Fixed Rate Mortgage vs. 15 Year:

This search explores the trade-offs between longer-term 30 year fixed rate mortgages and shorter-term 15-year mortgages. Comparing interest rates, monthly payments, and total interest paid over the life of the loan helps determine the most financially advantageous option.

5. 30 Year Fixed Rate Mortgage Rates by State:

This search highlights the geographic variations in mortgage rates across different states. Understanding regional differences in housing markets, economic conditions, and lender competition can provide valuable insights for finding the best mortgage rate.

6. 30 Year Fixed Rate Mortgage with No Down Payment:

This search reflects the desire to explore mortgage options that require minimal upfront investment. Understanding the eligibility criteria, potential risks, and available programs for no-down-payment mortgages is essential for informed decision-making.

7. 30 Year Fixed Rate Mortgage Refinancing:

This search focuses on the process of refinancing an existing mortgage to potentially secure a lower interest rate or better loan terms. Evaluating current interest rates, remaining loan balance, and refinancing costs is crucial before making a decision.

8. 30 Year Fixed Rate Mortgage Prepayment Penalty:

This search explores the potential consequences of prepaying a mortgage early. Understanding whether a mortgage carries a prepayment penalty clause is essential for avoiding unexpected fees and maximizing financial flexibility.

FAQs about 30 Year Fixed Rate Mortgage Trends in 2025:

1. What factors will drive 30 year fixed rate mortgage trends in 2025?

The key factors influencing 30 year fixed rate mortgages in 2025 include Federal Reserve policy, inflation, economic growth, government policies, supply and demand dynamics in the housing market, and technological advancements in the mortgage industry.

2. What is the expected range for 30 year fixed rate mortgages in 2025?

Predicting specific interest rate ranges for 30 year fixed rate mortgages is challenging. However, analyzing historical data, economic indicators, and expert forecasts can provide insights into potential rate movements.

3. How will rising interest rates affect 30 year fixed rate mortgages?

Rising interest rates will likely lead to higher 30 year fixed rate mortgages, making homeownership less affordable for some buyers. This could potentially slow down the housing market.

4. Will 30 year fixed rate mortgages be more or less affordable in 2025?

The affordability of 30 year fixed rate mortgages in 2025 will depend on the interplay of interest rates, home prices, and consumer income levels. A combination of factors will determine whether mortgages become more or less accessible.

5. What are some tips for navigating the 30 year fixed rate mortgage market in 2025?

- Carefully assess your financial situation and affordability threshold.

- Stay informed about current trends in the housing market.

- Consult with a financial advisor or mortgage broker for professional guidance.

- Explore alternative mortgage options and compare different lenders.

Tips for Navigating the 30 Year Fixed Rate Mortgage Market in 2025:

- Shop Around: Compare rates and terms from multiple lenders to secure the best possible deal.

- Consider Your Financial Situation: Evaluate your income, expenses, and debt levels to determine your affordability threshold.

- Get Pre-Approved: A pre-approval letter demonstrates your financial readiness to lenders and can strengthen your negotiating position.

- Understand the Loan Terms: Carefully review the loan agreement, including interest rates, fees, and any potential penalties.

- Protect Yourself: Consider purchasing mortgage insurance to protect against potential financial hardship in case of job loss or illness.

Conclusion:

The future of 30 year fixed rate mortgages in 2025 is intertwined with the broader economic landscape, influenced by factors such as inflation, interest rates, and housing market dynamics. While predicting the exact trajectory of rates is impossible, understanding the underlying forces and exploring potential scenarios can empower individuals and investors to make informed decisions. By staying informed, carefully assessing their financial situation, and seeking professional guidance, prospective homeowners can navigate the mortgage market with greater confidence and potentially achieve their homeownership goals.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Future: Exploring 30 Year Fixed Rate Mortgage Trends in 2025. We hope you find this article informative and beneficial. See you in our next article!