Navigating the Future: Interest Rates Trends Graph 2025

Related Articles: Navigating the Future: Interest Rates Trends Graph 2025

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Future: Interest Rates Trends Graph 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Navigating the Future: Interest Rates Trends Graph 2025

- 2 Introduction

- 3 Navigating the Future: Interest Rates Trends Graph 2025

- 3.1 Understanding the Interest Rates Trends Graph 2025

- 3.2 Benefits of Analyzing the Interest Rates Trends Graph 2025

- 3.3 Interpreting the Interest Rates Trends Graph 2025

- 3.4 Related Searches for Interest Rates Trends Graph 2025

- 3.5 FAQs about Interest Rates Trends Graph 2025

- 3.6 Tips for Utilizing the Interest Rates Trends Graph 2025

- 3.7 Conclusion: Navigating the Future with the Interest Rates Trends Graph 2025

- 4 Closure

Navigating the Future: Interest Rates Trends Graph 2025

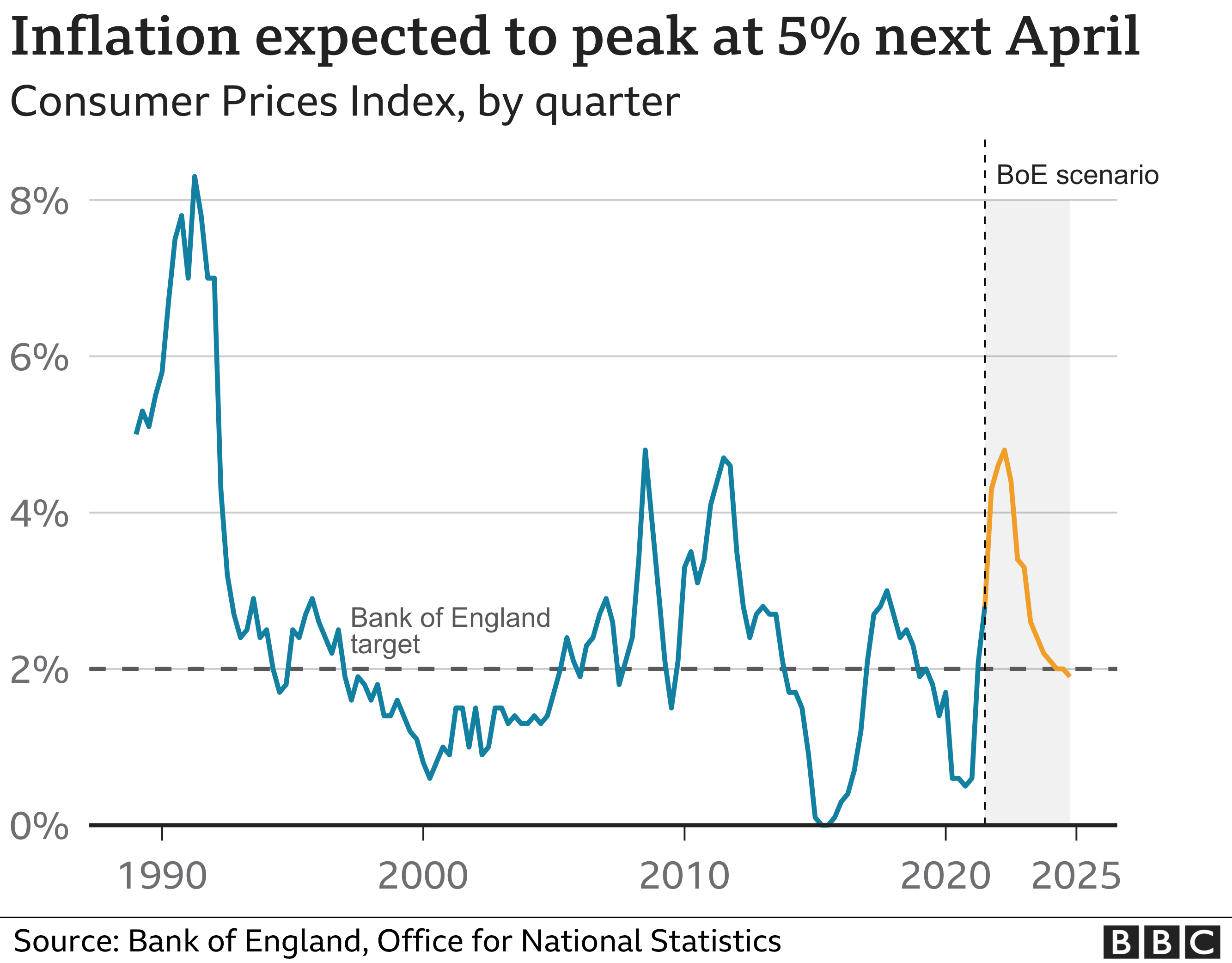

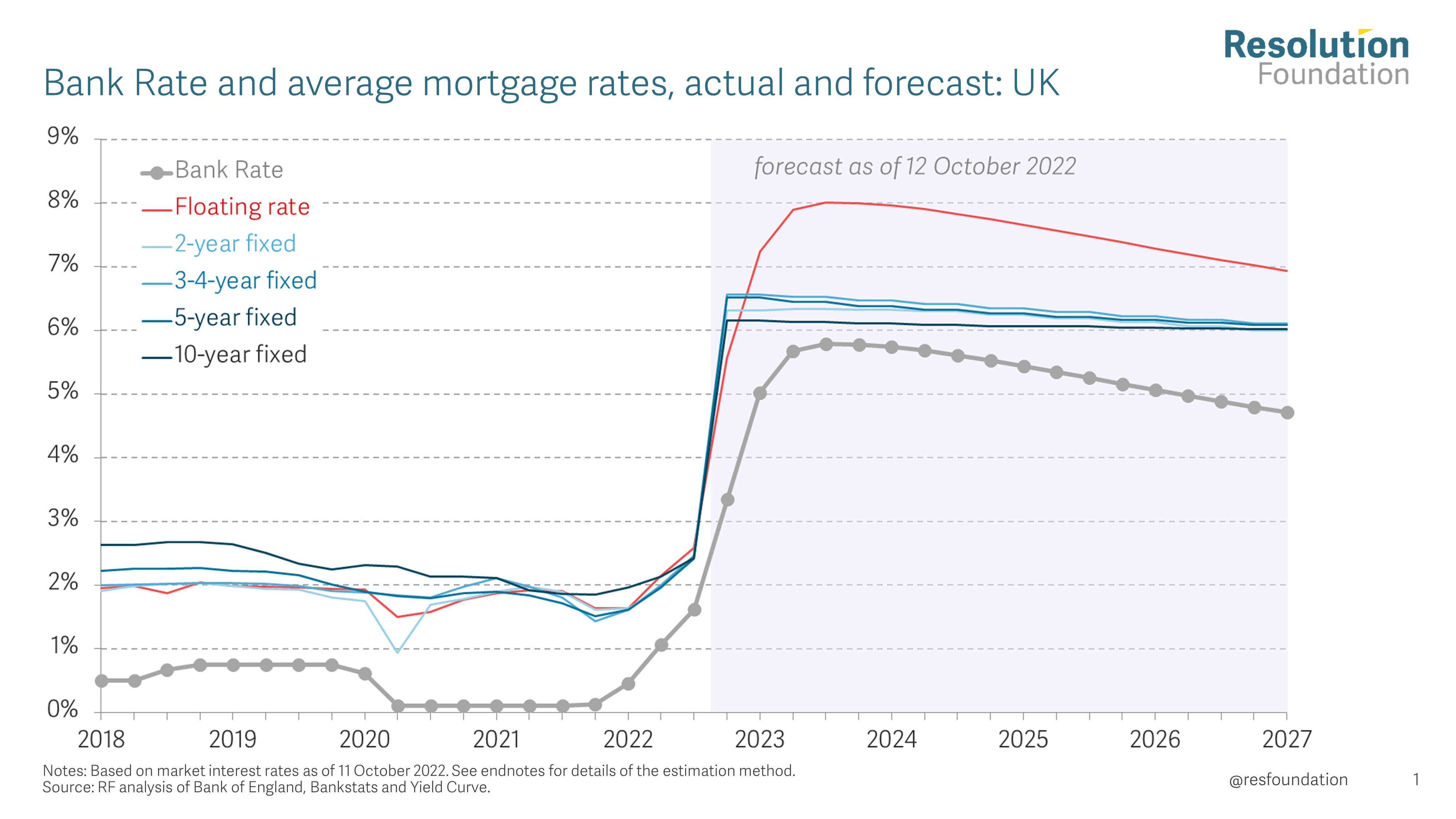

The interest rates trends graph 2025 is a crucial tool for understanding the potential trajectory of borrowing costs and their impact on various economic sectors. This graph, often presented as a visual representation of projected interest rate movements, helps investors, businesses, and individuals alike make informed decisions based on anticipated future economic conditions.

Understanding the Interest Rates Trends Graph 2025

The interest rates trends graph 2025 typically depicts the anticipated movement of key interest rates, such as the federal funds rate in the United States or the base rate in the United Kingdom, over the next few years. It is constructed based on a variety of factors, including:

- Economic Growth Projections: Expected GDP growth rates, inflation levels, and employment figures influence the direction of interest rates. Higher growth and inflation generally lead to rising rates.

- Monetary Policy Decisions: Central banks, such as the Federal Reserve in the U.S., adjust interest rates to control inflation and stabilize the economy. These decisions are reflected in the graph.

- Market Sentiment: Investor confidence and expectations about future economic performance play a role in shaping the interest rate curve.

- Global Economic Events: International developments, such as geopolitical tensions or global trade disputes, can impact interest rate trends.

Benefits of Analyzing the Interest Rates Trends Graph 2025

Understanding the potential direction of interest rates provides several benefits for various stakeholders:

- Investors: The graph helps investors make informed decisions about asset allocation, bond yields, and investment strategies.

- Businesses: Businesses can assess the cost of borrowing for expansion, investments, and working capital needs.

- Individuals: Understanding interest rate trends can aid in planning for mortgage rates, savings accounts, and other financial decisions.

- Policymakers: The graph provides valuable insights for policymakers in formulating economic policies and managing inflation.

Interpreting the Interest Rates Trends Graph 2025

The interest rates trends graph 2025 is not a definitive prediction but rather a representation of potential scenarios based on current economic data and projections. It’s crucial to understand the following:

- Upward Trend: An upward sloping curve suggests rising interest rates, potentially indicating economic growth and higher inflation.

- Downward Trend: A downward sloping curve indicates falling interest rates, which could signal slowing economic growth or efforts to stimulate the economy.

- Flat Trend: A flat curve suggests stable interest rates, implying a balanced economic environment.

Related Searches for Interest Rates Trends Graph 2025

Understanding the interest rates trends graph 2025 often requires exploring related searches that provide further context and insights:

1. Interest Rates Forecast 2025: This search provides detailed forecasts for interest rates in 2025, often from reputable financial institutions and economic analysts.

2. Interest Rates Projections 2025: Similar to forecasts, projections offer insights into potential interest rate movements based on various economic models and assumptions.

3. Interest Rates History Chart: Reviewing historical interest rate trends helps understand past patterns and identify potential future scenarios.

4. Interest Rates Impact on Economy: Analyzing the relationship between interest rates and economic growth, inflation, and other key indicators provides valuable insights.

5. Interest Rates Impact on Stock Market: Interest rate movements can influence stock prices, making it essential to understand their correlation.

6. Interest Rates Impact on Real Estate: Rising interest rates can increase borrowing costs for mortgages, impacting real estate prices and affordability.

7. Interest Rates Impact on Bonds: Interest rate changes directly impact bond yields, making it crucial for investors to analyze their potential impact.

8. Interest Rates Impact on Currency: Interest rate differentials can affect currency exchange rates, impacting international trade and investment.

FAQs about Interest Rates Trends Graph 2025

1. What factors influence the interest rates trends graph 2025?

The interest rates trends graph 2025 is shaped by various factors, including economic growth projections, inflation levels, central bank policies, market sentiment, and global economic events.

2. How accurate are the interest rates trends graph 2025 predictions?

The interest rates trends graph 2025 is not a guarantee of future outcomes but rather a representation of potential scenarios based on current data and assumptions. Economic conditions can change rapidly, leading to deviations from projected trends.

3. How can I use the interest rates trends graph 2025 for my financial planning?

Understanding the interest rates trends graph 2025 can help you make informed decisions about investments, savings, mortgages, and other financial planning aspects.

4. What are the potential risks associated with interest rate changes?

Rising interest rates can increase borrowing costs for businesses and individuals, potentially leading to reduced investment and economic slowdown. Conversely, falling interest rates can lead to inflation and asset bubbles.

5. How does the interest rates trends graph 2025 impact different industries?

Different industries are affected by interest rate changes in various ways. For example, rising rates can benefit banks but hurt industries with high debt levels.

6. What are the implications of a flat interest rate trend in 2025?

A flat trend in the interest rates trends graph 2025 suggests a stable economic environment with balanced growth and inflation. However, it could also indicate a lack of economic momentum.

7. How can I stay updated on interest rate trends?

Stay informed by following financial news, reputable economic analysis, and publications from central banks and financial institutions.

8. What are some resources for accessing the interest rates trends graph 2025?

Several financial websites, economic research institutions, and central bank publications provide access to interest rate projections and graphs.

Tips for Utilizing the Interest Rates Trends Graph 2025

- Consult multiple sources: Compare projections from different institutions to get a comprehensive view.

- Understand the assumptions: Be aware of the underlying economic models and assumptions used to create the graph.

- Consider historical trends: Analyze historical interest rate patterns to identify potential future scenarios.

- Stay informed about global economic events: International developments can significantly impact interest rate trends.

- Seek professional advice: Consult with financial advisors for personalized guidance based on your individual circumstances.

Conclusion: Navigating the Future with the Interest Rates Trends Graph 2025

The interest rates trends graph 2025 is an essential tool for navigating the complexities of future economic conditions. By understanding its potential implications, investors, businesses, and individuals can make informed decisions about their financial strategies, ensuring they are well-positioned to adapt to changing economic landscapes. While the graph itself is not a definitive prediction, it provides valuable insights into potential scenarios, helping stakeholders make informed choices and navigate the future with greater confidence.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Future: Interest Rates Trends Graph 2025. We hope you find this article informative and beneficial. See you in our next article!