Navigating the Future: Stock Trends 2025

Related Articles: Navigating the Future: Stock Trends 2025

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Future: Stock Trends 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Future: Stock Trends 2025

The world of finance is constantly evolving, driven by technological advancements, shifting societal values, and global economic trends. Predicting the future of the stock market is a complex endeavor, yet understanding the potential drivers of change can provide valuable insights for investors. This article delves into the key stock trends 2025 that may shape the investment landscape in the years to come.

1. The Rise of Sustainable Investing

Environmental, social, and governance (ESG) factors are gaining increasing prominence in investment decisions. Investors are increasingly demanding that companies demonstrate responsible practices in areas such as climate change mitigation, social equity, and ethical business conduct. This trend is likely to accelerate in the coming years, driving demand for companies with strong ESG credentials and pushing lagging companies to improve their performance.

-

Impact on Stock Trends: Companies with strong ESG ratings are expected to attract higher valuations and potentially outperform their less sustainable counterparts. Investors are increasingly looking for opportunities to align their portfolios with their values, leading to a shift towards companies with positive social and environmental impact.

-

Examples: The rise of ESG investing is evident in the growing popularity of ESG-focused funds and ETFs. For instance, the iShares Global Clean Energy ETF (ICLN) has seen significant growth in assets under management, reflecting investor interest in clean energy solutions. Similarly, the MSCI Global Select Socially Responsible Index (MSCI GSSRI) tracks the performance of companies with strong ESG practices, providing a benchmark for responsible investing.

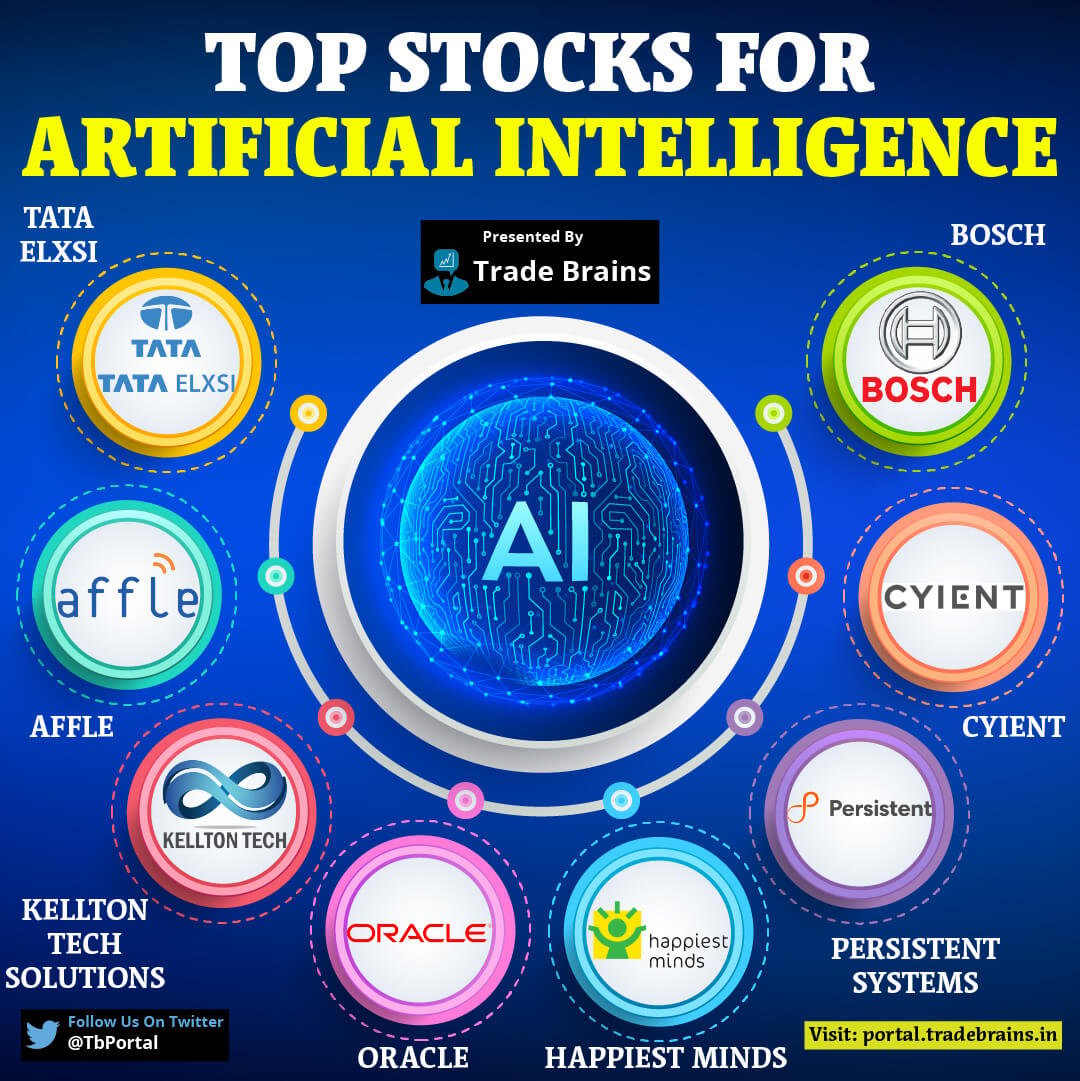

2. Technological Disruption and Innovation

Rapid advancements in technology continue to reshape industries and create new investment opportunities. Artificial intelligence (AI), cloud computing, biotechnology, and renewable energy are just a few examples of sectors poised for significant growth in the coming years.

-

Impact on Stock Trends: Companies at the forefront of technological innovation are likely to experience significant growth and attract significant investor interest. This could lead to higher valuations and potential outperformance compared to companies in more traditional sectors.

-

Examples: The rise of cloud computing has led to a surge in demand for companies like Amazon Web Services (AWS) and Microsoft Azure. Similarly, the development of AI-powered technologies is driving growth in companies like Nvidia, which provides the chips that power AI systems.

3. The Growing Importance of Data

Data is becoming increasingly valuable in today’s world, and its role in financial markets is only expected to grow. Companies that can effectively collect, analyze, and leverage data are likely to gain a competitive advantage.

-

Impact on Stock Trends: Companies with strong data analytics capabilities and data-driven decision-making processes are likely to be well-positioned for future growth. Investors may favor companies that can demonstrate a clear strategy for leveraging data to improve efficiency, optimize operations, and enhance customer experiences.

-

Examples: Data analytics companies like Palantir Technologies and Databricks are gaining traction as investors recognize the importance of data in today’s business environment. Similarly, companies that use data to personalize customer experiences, such as Netflix and Amazon, are likely to benefit from this trend.

4. The Rise of the Gig Economy

The gig economy, characterized by freelance work and temporary employment, is rapidly expanding. This shift in the labor market presents both challenges and opportunities for companies and investors.

-

Impact on Stock Trends: Companies that offer flexible work arrangements, provide platforms for freelancers, or cater to the needs of the gig economy workforce are likely to benefit from this trend. Investors may seek out companies that are well-positioned to navigate this evolving labor market.

-

Examples: Companies like Upwork, Fiverr, and Uber are leading players in the gig economy, providing platforms for freelancers and connecting them with clients. These companies are likely to see continued growth as the gig economy expands.

5. The Growing Importance of Healthcare

The aging global population and advancements in medical technology are driving growth in the healthcare sector. From pharmaceuticals and medical devices to telehealth and personalized medicine, there are numerous opportunities for investors in this space.

-

Impact on Stock Trends: Companies involved in healthcare innovation, such as those developing new drugs, therapies, and medical devices, are likely to attract significant investor interest. Investors may also seek out companies that are addressing specific healthcare challenges, such as chronic disease management or mental health.

-

Examples: Companies like Moderna, Pfizer, and Johnson & Johnson are leading players in the pharmaceutical industry, developing new vaccines and treatments. Similarly, companies like Abbott Laboratories and Medtronic are major players in the medical device industry, providing innovative solutions for various medical needs.

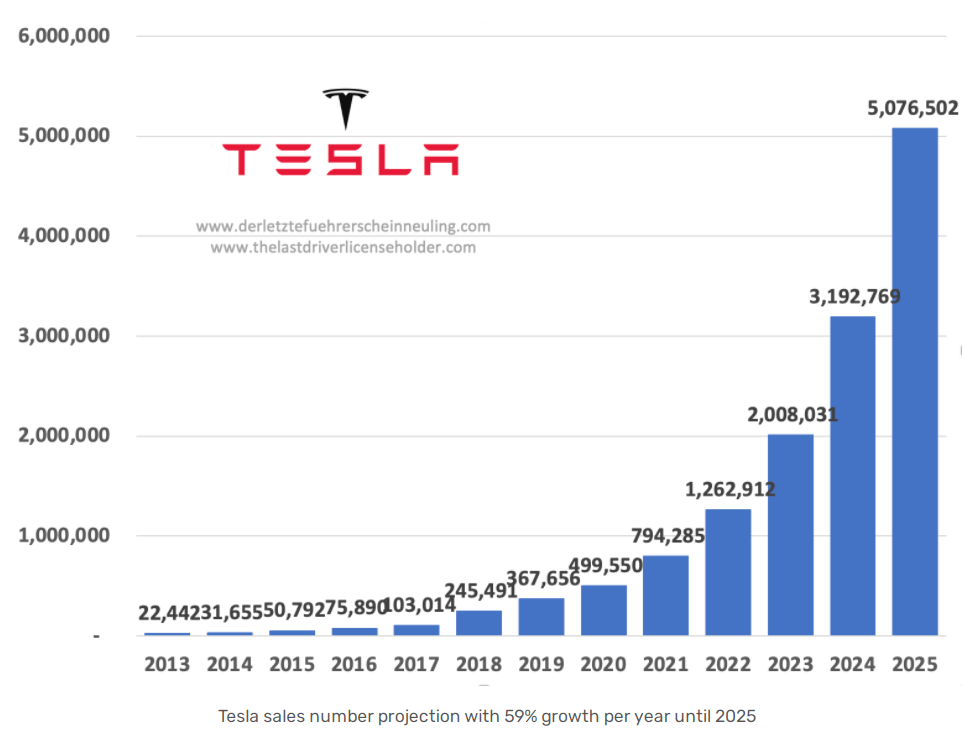

6. The Impact of Climate Change

Climate change is a growing concern for investors, as it poses significant risks to businesses and the global economy. Companies that are taking action to mitigate climate change and adapt to its impacts are likely to be well-positioned for the future.

-

Impact on Stock Trends: Companies with strong environmental performance, such as those investing in renewable energy, reducing emissions, and developing sustainable products, are likely to attract investors seeking to reduce their carbon footprint.

-

Examples: Companies like Tesla, Enphase Energy, and First Solar are leading players in the renewable energy sector, developing innovative solar and battery solutions. Similarly, companies like Unilever and Nestlé are taking steps to reduce their environmental impact and promote sustainable practices throughout their supply chains.

7. The Rise of Automation

Automation is rapidly transforming industries, from manufacturing to customer service. This trend is expected to continue in the coming years, leading to increased efficiency and productivity.

-

Impact on Stock Trends: Companies that are embracing automation and investing in technologies such as robotics and artificial intelligence are likely to see significant growth. Investors may seek out companies that are leveraging automation to improve their operations and gain a competitive advantage.

-

Examples: Companies like Fanuc, ABB, and Yaskawa are leading providers of industrial robots and automation solutions. Similarly, companies like UiPath and Automation Anywhere are developing software that automates business processes, leading to increased efficiency and cost savings.

8. The Importance of Cybersecurity

Cybersecurity threats are becoming increasingly sophisticated, posing significant risks to businesses and individuals alike. Companies that are investing in robust cybersecurity measures are likely to be well-positioned to protect their assets and reputation.

-

Impact on Stock Trends: Companies with strong cybersecurity practices and investments in advanced security technologies are likely to attract investors who value data protection and security.

-

Examples: Companies like CrowdStrike, Palo Alto Networks, and Fortinet are leading providers of cybersecurity solutions, protecting businesses from cyberattacks and data breaches.

Related Searches

- Stock Market Predictions 2025: Exploring broader predictions about the overall direction of the stock market in 2025.

- Top Stocks to Buy in 2025: Identifying specific stocks with potential for growth in the coming years.

- Investing Trends 2025: Examining broader investment trends beyond the stock market, including real estate, commodities, and alternative investments.

- Economic Outlook 2025: Analyzing economic factors that may influence stock market performance, such as interest rates, inflation, and economic growth.

- Financial Technology Trends 2025: Exploring the impact of fintech on the financial industry, including advancements in payments, lending, and investment management.

- Global Stock Market Trends 2025: Examining the performance of stock markets across different regions and the factors influencing their growth.

- Artificial Intelligence in Finance 2025: Exploring the role of AI in financial decision-making, risk management, and investment strategies.

- Sustainable Finance Trends 2025: Analyzing the growth of sustainable investing and the impact of ESG factors on investment decisions.

FAQs

Q: What are the most important factors to consider when investing in stocks for 2025?

A: Investors should consider factors such as:

- Industry Trends: Identifying industries that are poised for growth in the coming years, such as technology, healthcare, and renewable energy.

- Company Fundamentals: Analyzing the financial performance, management team, and competitive landscape of individual companies.

- ESG Factors: Evaluating the environmental, social, and governance performance of companies to assess their long-term sustainability.

- Macroeconomic Factors: Considering the broader economic outlook, including interest rates, inflation, and economic growth.

Q: How can investors prepare for the changing stock market landscape in 2025?

A: Investors can prepare by:

- Diversifying Portfolios: Spreading investments across different asset classes, sectors, and geographies to reduce risk.

- Conducting Thorough Research: Understanding the factors driving stock market trends and analyzing individual companies before making investment decisions.

- Staying Informed: Keeping up with market news, economic data, and industry developments to make informed investment choices.

- Seeking Professional Advice: Consulting with financial advisors who can provide personalized guidance and portfolio management services.

Q: What are the potential risks associated with investing in stocks for 2025?

A: Investors should be aware of potential risks such as:

- Market Volatility: Fluctuations in stock prices, which can lead to losses.

- Economic Uncertainty: Unforeseen economic events, such as recessions or geopolitical instability, can impact stock market performance.

- Company-Specific Risks: Factors such as poor management, declining profitability, or competition can negatively affect individual companies.

- Technological Disruption: Rapid technological advancements can create challenges for companies that fail to adapt, leading to potential stock price declines.

Tips

- Stay informed about emerging trends: Continuously monitor industry developments, technological advancements, and regulatory changes that may impact the stock market.

- Develop a long-term investment strategy: Avoid short-term speculation and focus on investments that align with your financial goals and risk tolerance.

- Practice due diligence: Conduct thorough research on individual companies before investing, considering factors such as financial performance, management team, and competitive landscape.

- Seek professional advice: Consult with financial advisors who can provide personalized guidance and portfolio management services, especially for complex investment strategies.

Conclusion

The stock trends 2025 outlined in this article highlight the dynamic nature of the financial markets and the importance of staying informed about emerging trends. While predicting the future with absolute certainty is impossible, understanding these potential drivers of change can provide investors with valuable insights to navigate the evolving investment landscape. By focusing on long-term trends, conducting thorough research, and seeking professional advice, investors can position themselves to capitalize on the opportunities and mitigate the risks of the stock market in the years to come.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Future: Stock Trends 2025. We hope you find this article informative and beneficial. See you in our next article!