Navigating the Rhythms of the Market: Exploring Seasonal Stock Market Trends in 2025

Related Articles: Navigating the Rhythms of the Market: Exploring Seasonal Stock Market Trends in 2025

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Rhythms of the Market: Exploring Seasonal Stock Market Trends in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Rhythms of the Market: Exploring Seasonal Stock Market Trends in 2025

The stock market, a complex and dynamic entity, is often perceived as a realm of unpredictability. However, beneath the surface of seemingly random fluctuations, there lies a subtle rhythm – seasonal stock market trends. These recurring patterns, influenced by a confluence of factors, can provide valuable insights for investors seeking to navigate the market effectively.

While predicting the future with absolute certainty is impossible, understanding the historical tendencies of the market can offer a strategic advantage. This article delves into the potential seasonal stock market trends for 2025, exploring the underlying factors driving these patterns and highlighting their potential implications for investors.

Understanding the Seasonal Cycle

The stock market, like the natural world, exhibits seasonal tendencies. These patterns are not absolute guarantees but rather statistical probabilities based on historical data. Several factors contribute to these seasonal fluctuations, including:

- Economic Activity: The cyclical nature of economic activity, with periods of growth and contraction, influences investor sentiment and market performance.

- Consumer Spending: Seasonal shifts in consumer spending patterns, driven by holidays and weather, impact various sectors, particularly retail and tourism.

- Earnings Season: Companies release their quarterly earnings reports throughout the year, impacting stock prices based on performance.

- Market Psychology: Investor psychology plays a significant role, with factors like optimism and risk appetite influencing market direction.

Key Seasonal Trends to Watch in 2025

While past performance is not a guarantee of future results, historical data suggests several potential seasonal stock market trends for 2025. These trends should be considered alongside broader economic indicators and individual company fundamentals:

- January Effect: Historically, January has often witnessed a positive return, potentially attributed to investors reinvesting year-end bonuses and tax refunds.

- Sell in May and Go Away: This adage suggests that investors may benefit from selling stocks between May and October, a period often associated with lower market returns.

- Santa Claus Rally: The period between Christmas and New Year’s Day has historically seen a surge in stock prices, driven by optimism and year-end portfolio adjustments.

- Summer Slump: The months of July and August can experience a slowdown in market activity due to reduced trading volume and vacation season.

Beyond the General Trends

While these general trends provide a framework, it’s crucial to consider the specific sectors and industries that may exhibit unique seasonal patterns. For example:

- Energy: The energy sector often sees increased volatility during the winter months due to higher demand for heating fuels.

- Retail: The holiday season from November to December is a crucial period for retailers, with increased sales and potential stock price fluctuations.

- Tourism: Travel and hospitality companies experience peak seasons during summer and holiday periods, influencing their performance.

Factors to Consider

The effectiveness of seasonal stock market trends can be influenced by various factors, including:

- Economic Conditions: A strong economic environment can dampen seasonal patterns as investors focus on broader growth prospects.

- Geopolitical Events: Unforeseen events like wars, political instability, or natural disasters can disrupt established seasonal trends.

- Market Volatility: Periods of heightened volatility can overshadow seasonal patterns, making it challenging to identify clear trends.

Benefits of Understanding Seasonal Trends

While not a foolproof method, understanding seasonal stock market trends can offer several benefits for investors:

- Informed Decision-Making: It provides a framework for evaluating market behavior and potential opportunities.

- Risk Management: Recognizing seasonal patterns can help investors manage risk by adjusting portfolio allocations.

- Strategic Timing: Understanding seasonal tendencies can guide investment decisions, potentially optimizing returns.

Related Searches

To gain a more comprehensive understanding of seasonal stock market trends, it’s helpful to explore related search topics:

- Seasonal Stock Market Calendar: Provides a detailed breakdown of key seasonal periods and their potential impact.

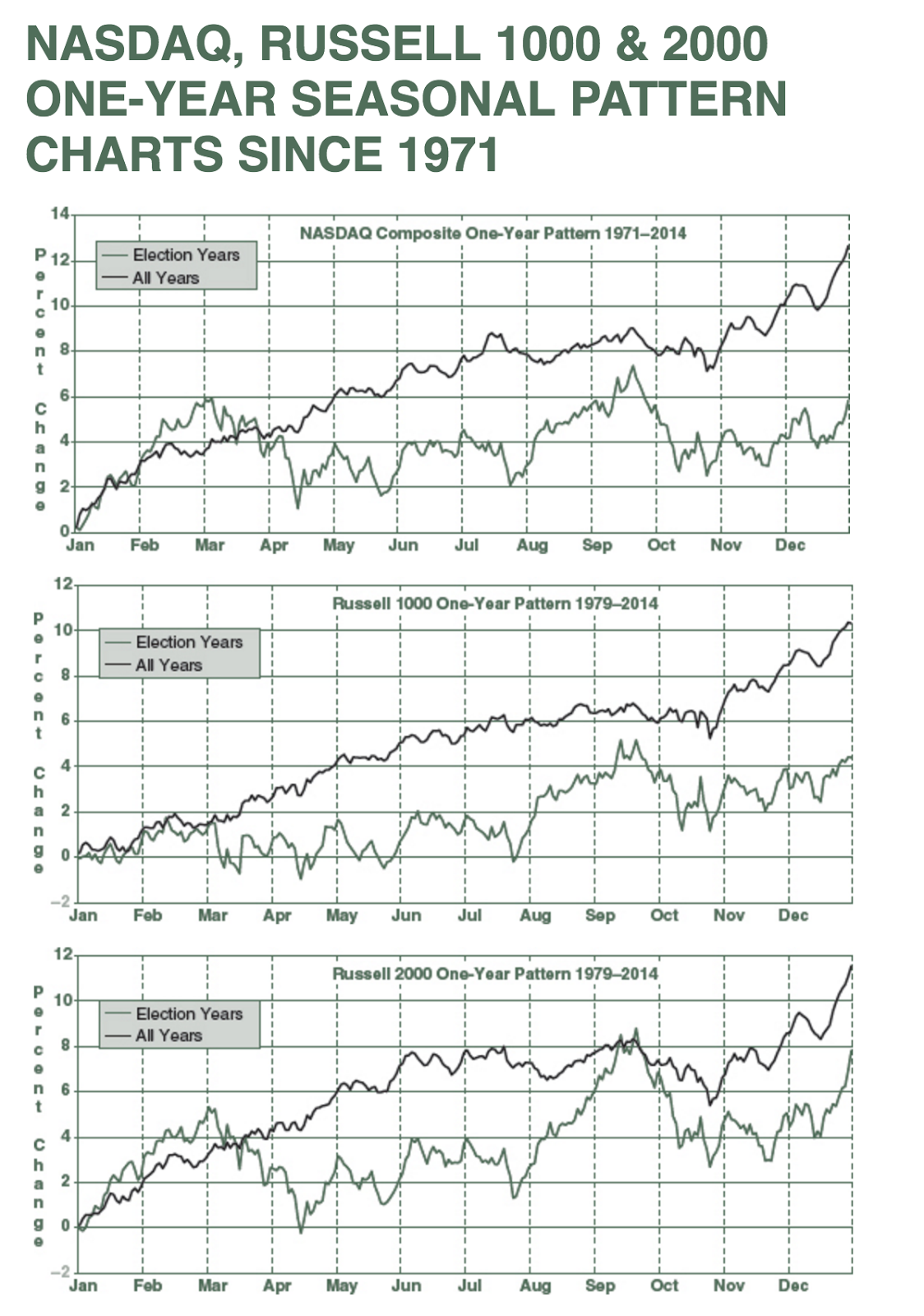

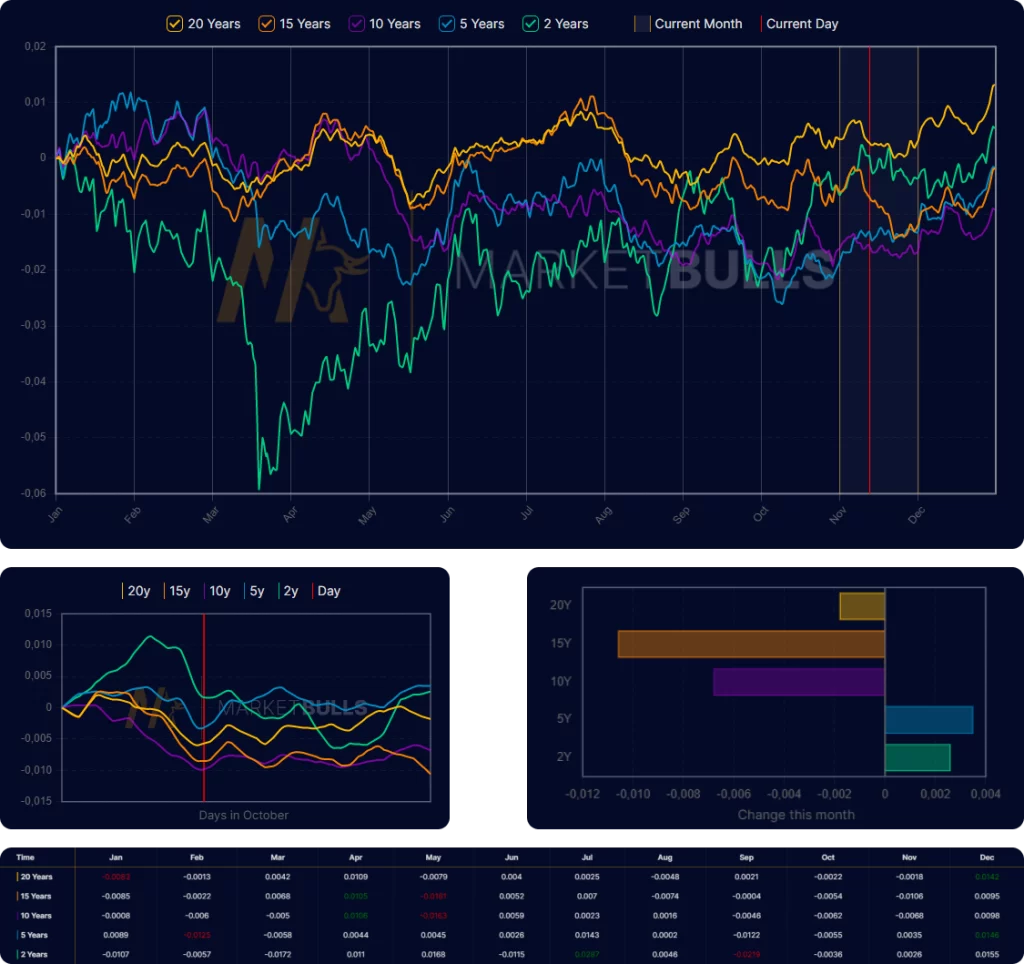

- Seasonal Stock Market Patterns: Explores historical data and statistical analysis to identify recurring trends.

- Best Stocks to Buy in Each Season: Offers insights into sector-specific seasonal patterns and potential investment opportunities.

- Seasonal Stock Market Volatility: Analyzes the relationship between seasonality and market volatility.

- Seasonal Stock Market Returns: Examines historical data to identify average seasonal returns for different market indices.

- Seasonal Stock Market Strategies: Presents various investment strategies based on seasonal patterns.

- Seasonal Stock Market Analysis: Provides a framework for analyzing seasonal trends and their implications.

- Seasonal Stock Market Predictions: Offers forecasts and insights into potential seasonal patterns for the future.

FAQs

1. Are seasonal stock market trends reliable indicators of future performance?

While past performance can provide insights, it’s crucial to remember that markets are dynamic and subject to various influences. Seasonal trends should be considered alongside other factors and not used as the sole basis for investment decisions.

2. How can investors utilize seasonal trends in their investment strategies?

Investors can incorporate seasonal patterns into their strategies by:

- Adjusting portfolio allocations: Shifting investments towards sectors expected to perform well during specific seasons.

- Timing trades: Entering and exiting positions based on anticipated seasonal movements.

- Monitoring market activity: Paying close attention to seasonal patterns and their potential impact on investments.

3. What are the limitations of seasonal stock market trends?

Seasonal trends are not absolute guarantees and can be influenced by economic conditions, geopolitical events, and market volatility. It’s essential to consider these factors when evaluating seasonal patterns.

4. Are there any specific sectors that tend to exhibit strong seasonal patterns?

Yes, certain sectors, such as retail, energy, tourism, and agriculture, often exhibit pronounced seasonal patterns due to their dependence on consumer spending, weather conditions, or other factors.

5. Can seasonal trends be applied to all markets?

While seasonal trends are observed in various markets, their strength and relevance can vary depending on the specific market and its underlying factors.

Tips for Utilizing Seasonal Stock Market Trends

- Research and analysis: Thoroughly research historical data and identify consistent seasonal patterns.

- Diversification: Don’t rely solely on seasonal trends. Diversify your portfolio across different sectors and asset classes.

- Risk management: Understand the potential risks associated with seasonal patterns and implement appropriate risk management strategies.

- Flexibility: Be prepared to adjust your strategy based on changing market conditions and unforeseen events.

Conclusion

Seasonal stock market trends offer a valuable framework for understanding the cyclical nature of the market. By recognizing these patterns, investors can gain insights into potential opportunities and manage risk more effectively. However, it’s crucial to remember that these trends are not guarantees and should be considered alongside broader market analysis and individual investment goals.

As we approach 2025, understanding the potential seasonal stock market trends can empower investors to navigate the market with greater confidence and make informed decisions that align with their investment objectives.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Rhythms of the Market: Exploring Seasonal Stock Market Trends in 2025. We thank you for taking the time to read this article. See you in our next article!