Navigating the Shifting Landscape: Mortgage Rates Trends This Week 2025

Related Articles: Navigating the Shifting Landscape: Mortgage Rates Trends This Week 2025

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Shifting Landscape: Mortgage Rates Trends This Week 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Shifting Landscape: Mortgage Rates Trends This Week 2025

Predicting the future is inherently challenging, especially in the dynamic realm of finance. However, understanding the factors that influence mortgage rates trends this week 2025 allows for informed decisions and strategic planning. This analysis delves into the key drivers of mortgage rate fluctuations, providing insights into potential scenarios and their implications for borrowers and lenders alike.

Understanding the Fundamentals

Mortgage rates are essentially the cost of borrowing money to purchase a home. They are influenced by a complex interplay of economic indicators, monetary policy, and market sentiment.

Key Drivers of Mortgage Rates Trends This Week 2025

1. Federal Reserve Policy: The Federal Reserve (Fed) plays a pivotal role in shaping interest rate trends. Its decisions regarding the federal funds rate, a benchmark interest rate, directly impact borrowing costs across the economy, including mortgage rates.

-

Potential Scenarios:

- Rate Hikes: The Fed might continue raising interest rates to combat inflation. This could lead to higher mortgage rates, making homeownership more expensive.

- Rate Pauses or Cuts: If inflation cools down significantly, the Fed might pause or even cut interest rates. This could potentially lower mortgage rates, making homeownership more affordable.

2. Inflation: Persistent inflation erodes purchasing power and prompts central banks to raise interest rates to curb price increases. This can lead to higher mortgage rates.

-

Potential Scenarios:

- Inflation Remains High: If inflation remains elevated, the Fed is likely to continue tightening monetary policy, potentially pushing mortgage rates higher.

- Inflation Declines: If inflation cools down, the Fed might become less aggressive with rate hikes, potentially leading to a stabilization or even decline in mortgage rates.

3. Economic Growth: A robust economy generally supports higher interest rates, as investors demand higher returns for their investments. Conversely, a slowing economy can lead to lower interest rates.

-

Potential Scenarios:

- Strong Economic Growth: Strong economic growth might lead to higher mortgage rates as investors seek higher returns.

- Economic Slowdown: A slowdown in economic growth could potentially push mortgage rates lower as investors become more risk-averse.

4. Market Sentiment: Investor confidence and market sentiment play a significant role in shaping interest rates. Uncertainty or negative sentiment can lead to higher interest rates as investors seek safe haven assets.

-

Potential Scenarios:

- Positive Market Sentiment: Strong economic indicators and positive market sentiment could lead to lower mortgage rates as investors become more willing to take on risk.

- Negative Market Sentiment: Concerns about economic instability or geopolitical tensions could lead to higher mortgage rates as investors seek safer investments.

5. Supply and Demand for Housing: The dynamics of the housing market also influence mortgage rates. A high demand for housing coupled with limited supply can push prices higher, potentially leading to increased mortgage rates.

-

Potential Scenarios:

- High Housing Demand: Continued strong demand for housing could lead to higher mortgage rates as lenders adjust to the increased demand.

- Housing Market Slowdown: A slowdown in housing demand could potentially lead to lower mortgage rates as lenders become more competitive.

6. Government Policies: Government policies, such as tax incentives for homeownership or regulations impacting the mortgage market, can also influence mortgage rates.

-

Potential Scenarios:

- Favorable Housing Policies: Government policies aimed at stimulating homeownership, such as tax breaks or subsidies, could potentially lead to lower mortgage rates.

- Restrictive Housing Policies: Regulations that make it more difficult to obtain a mortgage or increase lending standards could potentially lead to higher mortgage rates.

Exploring Related Searches

1. Average Mortgage Rates This Week 2025: Understanding the current average mortgage rates provides a snapshot of the market and allows for comparisons with historical trends. This information is readily available from reputable financial institutions and mortgage rate trackers.

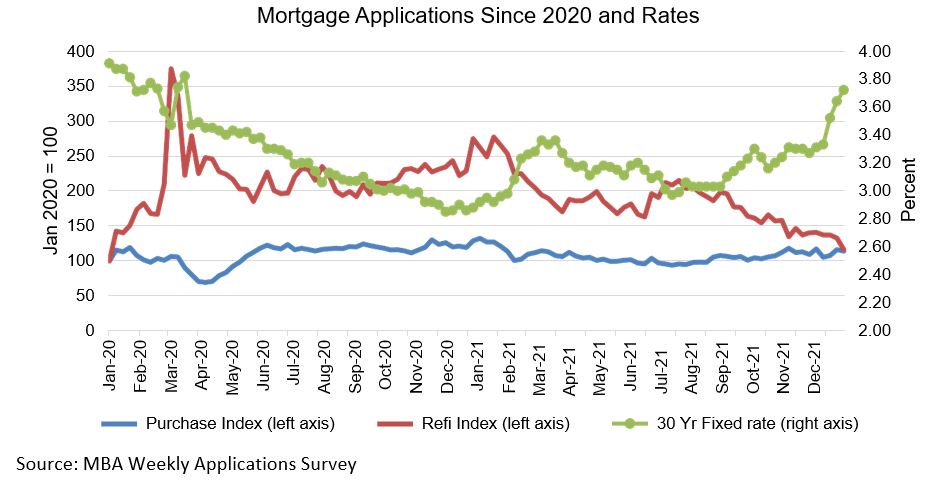

2. 30-Year Fixed Mortgage Rate Trends This Week 2025: The 30-year fixed mortgage rate is a popular choice for homebuyers due to its predictable monthly payments. Tracking its trends helps assess the current market landscape and potential future trajectory.

3. 15-Year Fixed Mortgage Rate Trends This Week 2025: The 15-year fixed mortgage rate offers a shorter loan term and potentially lower interest rates. Understanding its trends helps borrowers evaluate the pros and cons of this option.

4. Adjustable Rate Mortgage (ARM) Trends This Week 2025: ARMs offer initial lower interest rates but carry the risk of rate adjustments in the future. Monitoring ARM trends helps assess the potential cost savings and risks associated with this option.

5. Mortgage Rate Forecasts This Week 2025: While predicting future rates is inherently uncertain, various financial institutions and economists provide forecasts based on their analyses of economic indicators and market trends.

6. Factors Affecting Mortgage Rates This Week 2025: A comprehensive understanding of the factors driving mortgage rate fluctuations, as outlined above, empowers borrowers and lenders to make informed decisions based on current market conditions.

7. Mortgage Rate Calculator This Week 2025: Online mortgage rate calculators allow users to input loan details and estimate monthly payments based on current interest rates. This tool helps in budgeting and comparing different loan options.

8. Impact of Mortgage Rate Trends This Week 2025 on Housing Market: The interplay between mortgage rates and housing market dynamics is complex and constantly evolving. Understanding these trends allows for a more informed assessment of the housing market outlook.

Frequently Asked Questions (FAQs) About Mortgage Rates Trends This Week 2025

1. What are the current mortgage rates this week 2025?

Current mortgage rates fluctuate daily, influenced by the factors discussed above. To obtain the most up-to-date information, consult reputable financial institutions or mortgage rate trackers.

2. How do mortgage rates affect home affordability?

Higher mortgage rates increase the cost of borrowing, making homeownership more expensive. Conversely, lower mortgage rates make homeownership more affordable.

3. What are the implications of rising mortgage rates for homebuyers?

Rising mortgage rates can lead to higher monthly payments, potentially reducing the amount of home a buyer can afford. It might also make it more difficult to qualify for a loan.

4. What are the implications of falling mortgage rates for homebuyers?

Falling mortgage rates can lead to lower monthly payments, potentially increasing the affordability of homeownership. It might also make it easier to qualify for a loan.

5. What are the implications of mortgage rate trends for homeowners?

For homeowners with adjustable-rate mortgages, rising mortgage rates could lead to higher monthly payments. For those with fixed-rate mortgages, rates will remain stable throughout the loan term.

6. What are the implications of mortgage rate trends for the economy?

Mortgage rate trends can impact economic activity by influencing consumer spending and investment. Higher mortgage rates can slow down home sales and construction, while lower rates can stimulate these sectors.

7. What are the potential risks associated with adjustable-rate mortgages (ARMs)?

ARMs offer initial lower interest rates but carry the risk of rate adjustments in the future. This can lead to higher monthly payments if interest rates rise.

8. How can I find the best mortgage rates?

To find the best mortgage rates, compare offers from multiple lenders and consider factors such as loan terms, fees, and your credit score.

Tips for Navigating Mortgage Rates Trends This Week 2025

1. Stay Informed: Monitor economic indicators, Fed policy announcements, and mortgage rate trends to stay informed about market conditions.

2. Compare Lenders: Obtain quotes from multiple lenders to find the best rates and terms that suit your financial situation.

3. Consider Loan Options: Explore different loan types, such as fixed-rate mortgages and ARMs, to determine the best option for your needs and risk tolerance.

4. Improve Credit Score: A higher credit score can qualify you for lower interest rates. Take steps to improve your creditworthiness by paying bills on time and reducing debt.

5. Lock in Rates: If you anticipate rising mortgage rates, consider locking in a rate when rates are favorable.

6. Seek Professional Advice: Consult with a financial advisor or mortgage broker to gain expert insights and guidance on navigating mortgage rates and making informed decisions.

Conclusion

Mortgage rates trends this week 2025 are influenced by a complex interplay of economic factors, monetary policy, and market sentiment. Understanding these drivers allows for informed decisions and strategic planning. By staying informed, comparing lenders, and seeking professional advice, borrowers and lenders can navigate the shifting landscape of mortgage rates and make informed decisions that align with their financial goals.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Shifting Landscape: Mortgage Rates Trends This Week 2025. We hope you find this article informative and beneficial. See you in our next article!