Navigating the Uncharted Waters: Exploring Mortgage Refinance Rate Trends in 2025

Related Articles: Navigating the Uncharted Waters: Exploring Mortgage Refinance Rate Trends in 2025

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Uncharted Waters: Exploring Mortgage Refinance Rate Trends in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Uncharted Waters: Exploring Mortgage Refinance Rate Trends in 2025

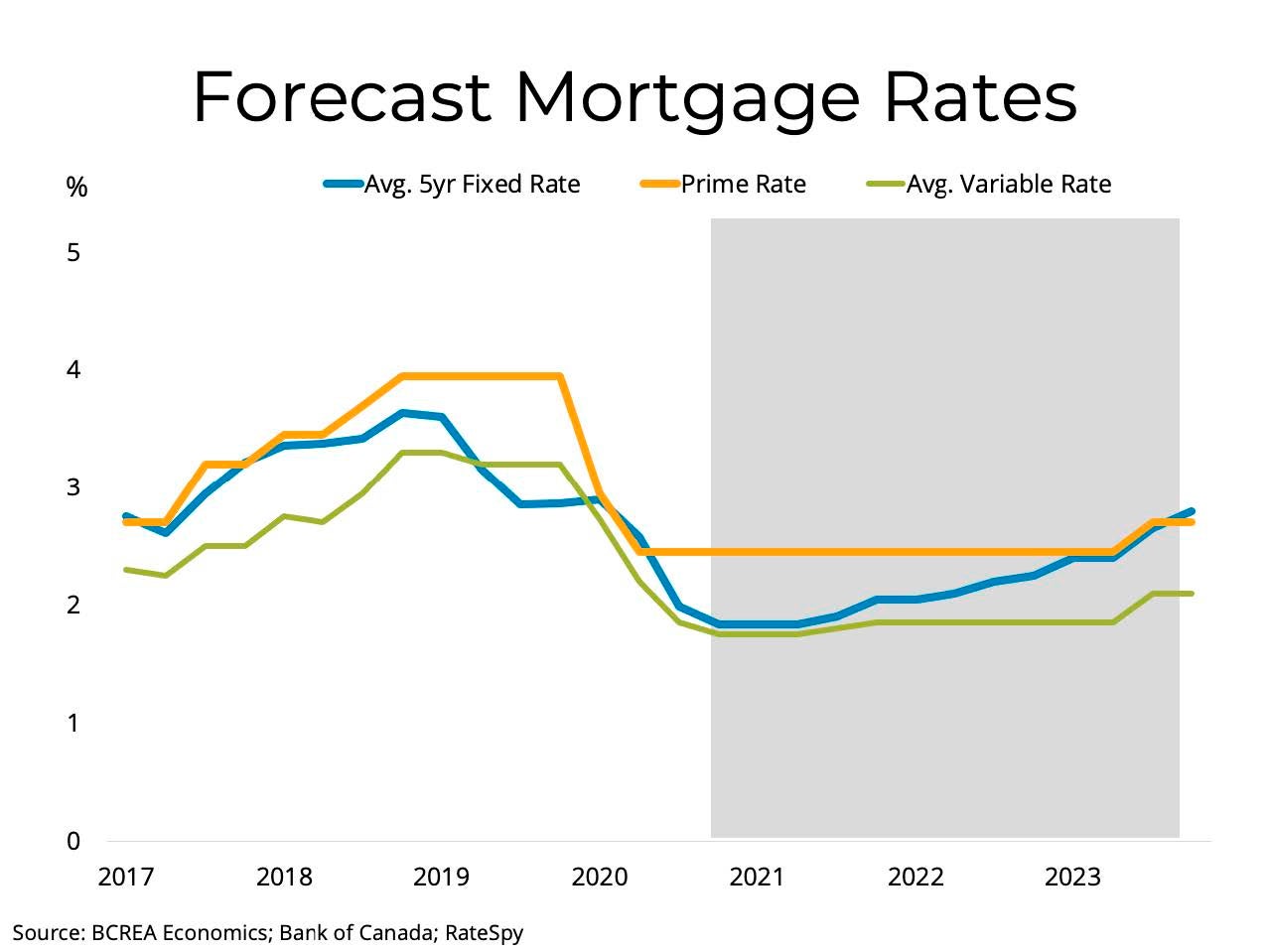

Predicting the future of mortgage refinance rate trends is a complex endeavor, influenced by a multitude of economic, political, and social factors. While pinpointing exact rates for 2025 remains impossible, understanding the current landscape and potential drivers of change provides valuable insight for homeowners considering refinancing.

Understanding the Dynamics of Mortgage Refinance Rates

Mortgage refinance rates are fundamentally tied to the broader interest rate environment. The Federal Reserve’s monetary policy, inflation, and economic growth all play a significant role in shaping the cost of borrowing money. When the Federal Reserve raises interest rates to combat inflation, mortgage rates typically rise as well, making refinancing less attractive. Conversely, lower interest rates often create opportunities for homeowners to secure more favorable terms.

Factors Influencing Mortgage Refinance Rate Trends in 2025

Several key factors will likely influence mortgage refinance rate trends in 2025:

- Inflation and the Federal Reserve: The Federal Reserve’s stance on inflation will be a primary driver. If inflation remains high or rises further, the Fed may continue to raise interest rates, pushing mortgage refinance rates upwards. Conversely, if inflation cools down, the Fed might shift to a more accommodative stance, potentially leading to lower rates.

- Economic Growth: A strong economy generally leads to higher interest rates as investors demand higher returns. Conversely, a weakening economy might prompt the Fed to lower rates, potentially creating favorable conditions for refinancing.

- Government Policies: Government policies, including tax incentives or regulations related to mortgage lending, can impact mortgage refinance rate trends. Changes to these policies could make refinancing more or less appealing.

- Global Economic Events: Global events, such as geopolitical tensions or international trade disputes, can create uncertainty and influence investor sentiment, impacting interest rates and mortgage refinance rate trends.

- Housing Market Conditions: The overall health of the housing market, including supply and demand dynamics, can also affect mortgage refinance rate trends. A robust housing market with strong demand might lead to higher interest rates, while a cooling market might see lower rates.

Exploring the Potential Scenarios for Mortgage Refinance Rate Trends in 2025

Based on these factors, several potential scenarios for mortgage refinance rate trends in 2025 can be envisioned:

- Scenario 1: Rising Rates: If inflation remains elevated and the Fed continues its aggressive rate hikes, mortgage refinance rates could climb further in 2025. This scenario might make refinancing less attractive for many homeowners, particularly those with lower interest rates on their existing mortgages.

- Scenario 2: Stabilizing Rates: If inflation cools down and the Fed adopts a more cautious approach to rate hikes, mortgage refinance rates could stabilize in 2025. This scenario might create opportunities for homeowners with higher interest rates to refinance and secure better terms.

- Scenario 3: Falling Rates: If the economy weakens significantly, the Fed might be forced to lower interest rates to stimulate growth. This scenario could lead to lower mortgage refinance rates in 2025, creating favorable refinancing opportunities for homeowners.

Related Searches: FAQs by Mortgage Refinance Rate Trends 2025

Here are some frequently asked questions related to mortgage refinance rate trends in 2025:

1. What are the current mortgage refinance rates?

Current mortgage refinance rates fluctuate daily based on market conditions. To get the most up-to-date information, consult with a mortgage lender or use online rate comparison tools.

2. How can I predict future mortgage refinance rates?

Predicting future mortgage refinance rates with absolute certainty is impossible. However, staying informed about economic indicators, Federal Reserve policies, and market trends can provide valuable insights.

3. What are the benefits of refinancing my mortgage?

Refinancing can offer several benefits, including:

- Lower monthly payments: Refinancing to a lower interest rate can significantly reduce your monthly mortgage payments.

- Shorter loan term: Refinancing to a shorter loan term can help you pay off your mortgage faster and save on interest charges.

- Cash-out refinance: A cash-out refinance allows you to borrow against your home’s equity, providing access to funds for home improvements, debt consolidation, or other expenses.

4. When is the best time to refinance my mortgage?

The best time to refinance depends on your individual circumstances and financial goals. Generally, refinancing is most advantageous when interest rates are lower than your current mortgage rate, and you have a strong credit score.

5. How can I find the best mortgage refinance rates?

To find the best mortgage refinance rates, compare offers from multiple lenders, consider your credit score and debt-to-income ratio, and explore different loan types and terms.

Tips by Mortgage Refinance Rate Trends 2025

Here are some tips for homeowners considering refinancing in 2025:

- Monitor interest rates: Stay informed about current mortgage refinance rates and their trends.

- Evaluate your financial situation: Assess your credit score, debt-to-income ratio, and overall financial health to determine your eligibility and affordability.

- Compare offers from multiple lenders: Shop around and compare offers from different lenders to secure the best rates and terms.

- Consider your long-term goals: Evaluate whether refinancing aligns with your long-term financial goals and plans.

- Consult with a mortgage professional: Seek advice from a qualified mortgage professional to understand your options and make informed decisions.

Conclusion by Mortgage Refinance Rate Trends 2025

While predicting the exact mortgage refinance rate trends in 2025 remains challenging, understanding the key factors influencing rates and exploring potential scenarios can help homeowners make informed decisions. Staying informed, evaluating your financial situation, and consulting with a mortgage professional are crucial steps in navigating the evolving landscape of mortgage refinancing. By carefully weighing your options and making strategic choices, homeowners can potentially benefit from favorable mortgage refinance rate trends in 2025.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Uncharted Waters: Exploring Mortgage Refinance Rate Trends in 2025. We thank you for taking the time to read this article. See you in our next article!