Steel Price Trends 2025: A Comprehensive Analysis

Related Articles: Steel Price Trends 2025: A Comprehensive Analysis

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Steel Price Trends 2025: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Steel Price Trends 2025: A Comprehensive Analysis

The steel industry, a cornerstone of global infrastructure and industrial development, is constantly evolving. Understanding the forces that shape steel price trends is crucial for businesses, investors, and policymakers alike. This article delves into the factors that will likely influence steel prices in 2025, providing insights into potential trends and their implications.

Factors Influencing Steel Prices in 2025

Several interconnected factors will shape steel price trends in 2025. These include:

1. Global Economic Growth:

The global economy’s health directly impacts demand for steel. Robust economic growth typically translates to increased construction, manufacturing, and infrastructure development, driving up steel demand. Conversely, economic downturns can lead to reduced steel consumption.

2. Infrastructure Development:

Governments worldwide are investing heavily in infrastructure projects, including roads, bridges, railways, and airports. These projects are major consumers of steel, and their scale and pace will significantly influence steel demand and pricing.

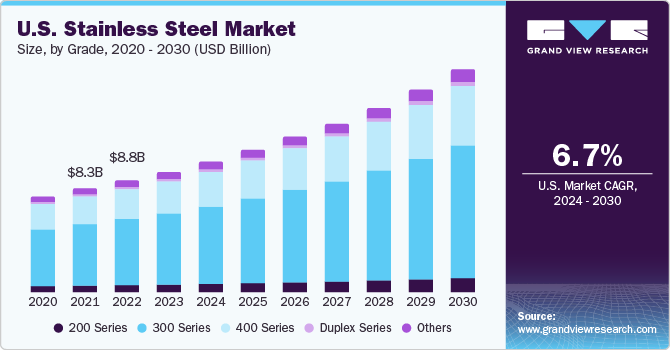

3. Manufacturing and Industrial Activity:

The manufacturing and industrial sectors heavily rely on steel for machinery, equipment, and production processes. Increased industrial activity, particularly in emerging markets, will likely fuel steel demand.

4. Supply Chain Dynamics:

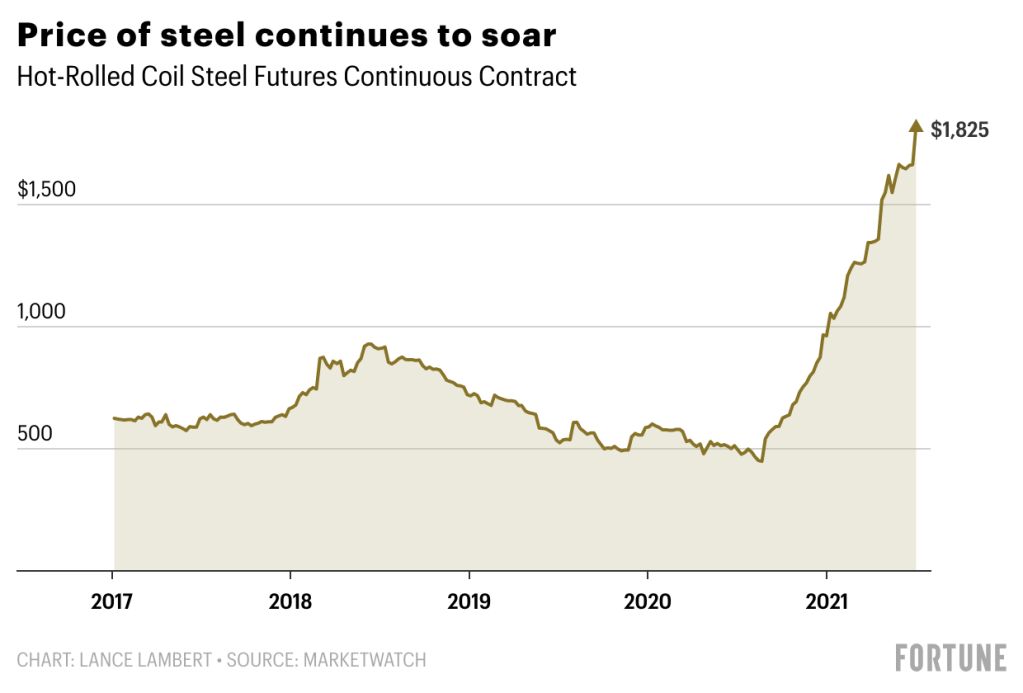

Global supply chain disruptions, such as those experienced during the COVID-19 pandemic, can significantly impact steel prices. Shortages in raw materials, transportation bottlenecks, and production disruptions can lead to price volatility.

5. Government Policies and Regulations:

Government policies, including trade tariffs, subsidies, and environmental regulations, can influence steel production costs and market dynamics. For example, carbon emissions regulations can impact steel production processes and potentially increase production costs.

6. Technological Advancements:

Technological advancements in steel production, such as the use of electric arc furnaces and advanced recycling methods, can affect production costs and potentially influence steel prices.

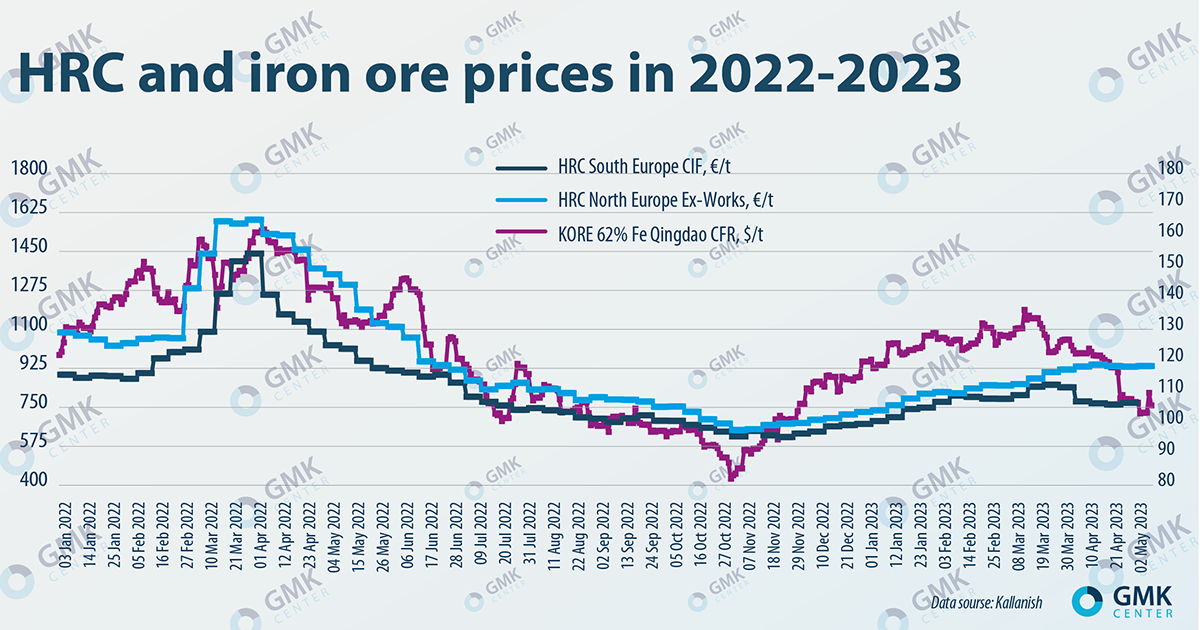

7. Raw Material Prices:

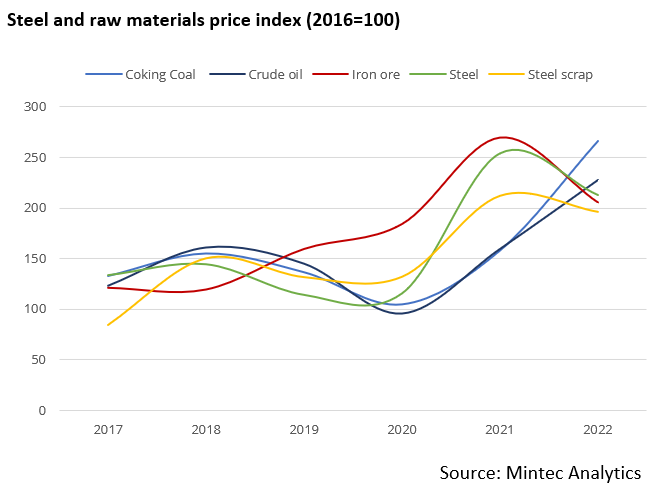

The cost of raw materials, such as iron ore, coal, and scrap metal, is a major factor in steel production costs. Fluctuations in these prices can directly impact steel prices.

8. Geopolitical Factors:

Geopolitical tensions and conflicts can disrupt global trade flows and impact steel production and supply chains. For example, sanctions or trade wars can lead to price volatility and supply shortages.

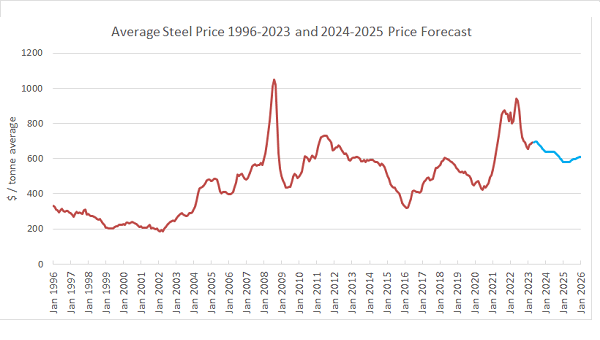

Potential Steel Price Trends in 2025

Based on the factors discussed above, several potential steel price trends can be anticipated in 2025:

- Moderate Price Growth: Continued global economic growth, coupled with infrastructure development and industrial activity, could lead to moderate increases in steel prices. However, factors like technological advancements and increased recycling could potentially mitigate price increases.

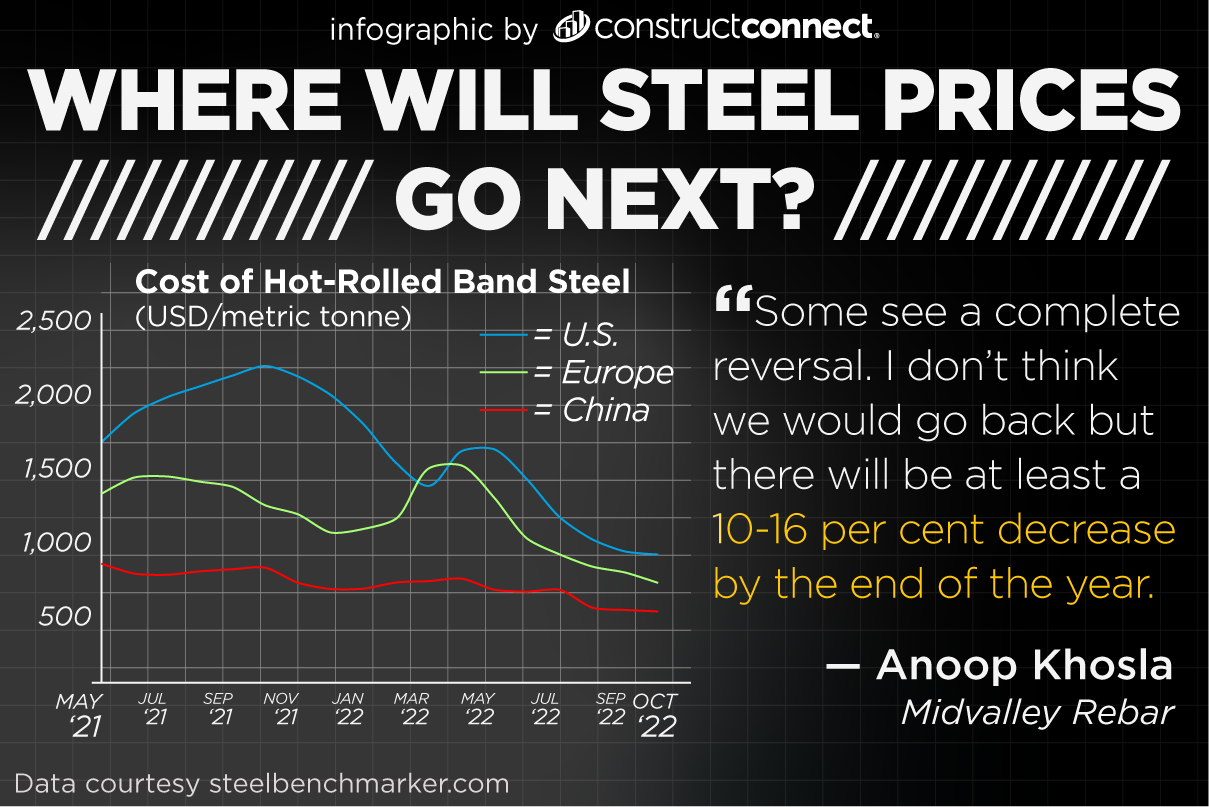

- Price Volatility: Supply chain disruptions, geopolitical tensions, and fluctuations in raw material prices could contribute to price volatility in the steel market.

- Regional Price Differences: Depending on local demand, supply chain dynamics, and government policies, steel prices may vary significantly across different regions.

- Increased Focus on Sustainability: Growing concerns about environmental sustainability could lead to increased demand for sustainable steel production methods, potentially influencing prices.

Related Searches

1. Steel Industry Outlook 2025: This search explores the overall health and prospects of the steel industry in 2025, considering factors like production capacity, demand growth, and technological advancements.

2. Iron Ore Price Forecast 2025: As a key raw material for steel production, understanding iron ore price trends is crucial for predicting steel price movements.

3. Global Steel Demand 2025: This search focuses on the projected global demand for steel in 2025, considering factors like economic growth, infrastructure development, and industrial activity.

4. Steel Production Costs 2025: This search examines the factors influencing steel production costs in 2025, including raw material prices, energy costs, and environmental regulations.

5. Steel Recycling Trends 2025: Increased recycling efforts can impact steel prices by influencing supply and demand dynamics. This search explores the trends in steel recycling and their potential impact on the market.

6. Sustainable Steel Production 2025: This search focuses on the growing trend of sustainable steel production methods and their implications for steel prices and market dynamics.

7. Steel Industry Innovation 2025: Technological advancements in steel production can impact costs, efficiency, and product quality, influencing steel prices. This search explores the latest innovations in the steel industry.

8. Steel Trade Wars 2025: Trade disputes and tariffs can significantly impact steel prices and market dynamics. This search examines the potential for trade conflicts and their impact on the steel industry.

FAQs

1. What are the key factors driving steel prices in 2025?

Global economic growth, infrastructure development, manufacturing activity, supply chain dynamics, government policies, technological advancements, raw material prices, and geopolitical factors will all play a significant role in shaping steel prices in 2025.

2. How will technological advancements impact steel prices in 2025?

Technological advancements in steel production, such as electric arc furnaces and advanced recycling methods, can potentially reduce production costs and influence steel prices. However, the impact will depend on the rate of adoption and the specific technologies involved.

3. What are the potential risks to steel price stability in 2025?

Supply chain disruptions, geopolitical tensions, fluctuations in raw material prices, and changes in government policies could all contribute to price volatility in the steel market.

4. What are the implications of increased sustainability in the steel industry for prices?

The growing focus on sustainable steel production methods could lead to higher costs for some production processes, potentially impacting steel prices. However, it could also lead to increased demand for sustainable steel, potentially offsetting price increases.

5. How can businesses prepare for potential steel price fluctuations in 2025?

Businesses can mitigate the impact of steel price fluctuations by diversifying their suppliers, hedging against price risks, and exploring alternative materials. They can also monitor market trends closely and adjust their strategies accordingly.

Tips

- Stay informed: Regularly monitor industry publications, market reports, and news sources to stay informed about the latest developments in the steel market.

- Analyze market trends: Analyze historical steel price data and identify key trends that might influence future price movements.

- Consider hedging strategies: Explore hedging options to mitigate price risks associated with steel purchases.

- Develop relationships with suppliers: Build strong relationships with reliable suppliers to ensure access to consistent supply and potentially negotiate favorable pricing.

- Explore alternative materials: Consider using alternative materials or technologies to reduce reliance on steel and potentially reduce costs.

Conclusion

Predicting steel price trends with absolute certainty is challenging due to the complex interplay of factors influencing the market. However, understanding the key drivers and potential trends can provide valuable insights for businesses, investors, and policymakers. By staying informed, analyzing market trends, and adapting their strategies accordingly, stakeholders can navigate the dynamic steel market and prepare for the challenges and opportunities that lie ahead.

The steel industry is constantly evolving, and understanding the forces that shape steel price trends is crucial for businesses, investors, and policymakers alike. By considering the factors discussed above, stakeholders can navigate the dynamic steel market and prepare for the challenges and opportunities that lie ahead.

Closure

Thus, we hope this article has provided valuable insights into Steel Price Trends 2025: A Comprehensive Analysis. We thank you for taking the time to read this article. See you in our next article!