The Evolving Landscape of Banking: Digital Trends Shaping the Future

Related Articles: The Evolving Landscape of Banking: Digital Trends Shaping the Future

Introduction

With great pleasure, we will explore the intriguing topic related to The Evolving Landscape of Banking: Digital Trends Shaping the Future. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Evolving Landscape of Banking: Digital Trends Shaping the Future

The banking industry is undergoing a profound transformation, driven by rapid technological advancements and evolving customer expectations. Digital trends banking are at the forefront of this evolution, shaping the future of financial services and redefining the customer experience.

Understanding the Drivers of Change

Several key factors are driving the digitalization of banking:

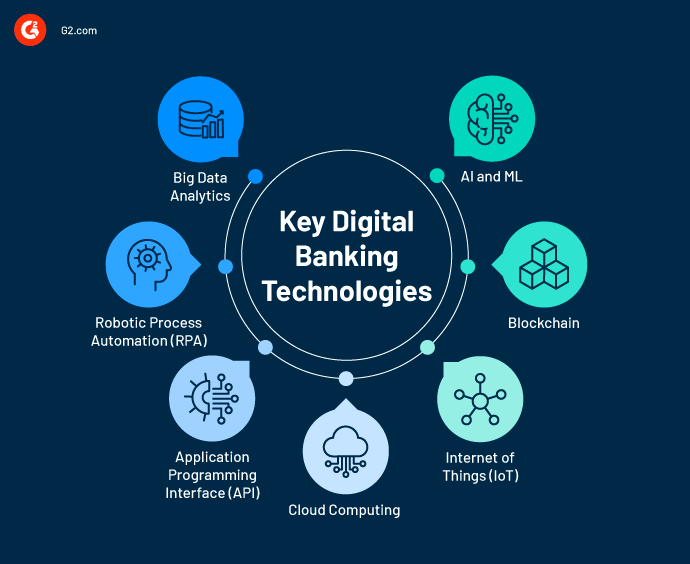

- Technological Advancements: The emergence of technologies like artificial intelligence (AI), blockchain, cloud computing, and the Internet of Things (IoT) are empowering banks to automate processes, enhance security, and offer personalized services.

- Shifting Customer Preferences: Consumers are increasingly comfortable with digital interactions, seeking convenience, speed, and personalized experiences. They demand seamless online and mobile banking solutions, accessible 24/7.

- Competition from Fintechs: The rise of fintech companies, specializing in innovative financial solutions, is forcing traditional banks to adapt and compete on a new playing field.

Key Digital Trends in Banking 2025

Here are some of the prominent trends shaping the future of banking:

1. Hyper-Personalization:

- AI-Powered Recommendations: Banks will leverage AI algorithms to analyze customer data and deliver personalized financial recommendations, product suggestions, and tailored investment strategies.

- Contextualized Services: Banking apps will utilize location, transaction history, and other data to provide contextually relevant services, such as suggesting nearby ATMs or offering discounts based on spending patterns.

- Proactive Customer Support: AI-powered chatbots and virtual assistants will provide instant, personalized support, resolving queries and addressing customer needs in real-time.

2. Seamless Omnichannel Experience:

- Unified Customer Journey: Banks will offer a seamless experience across all channels, from online banking platforms to mobile apps and physical branches.

- Integration of Digital and Physical: Physical branches will evolve into experience centers, offering personalized consultations and digital-assisted services.

- Biometric Authentication: Security will be enhanced through biometrics like facial recognition, voice authentication, and fingerprint scanning, providing a more secure and convenient login experience.

3. Open Banking and APIs:

- Data Sharing and Collaboration: Open banking allows customers to share their financial data with third-party applications, enabling innovative financial solutions and personalized services.

- Enhanced Financial Management: Customers can leverage third-party apps to manage their finances, track expenses, and gain insights into their spending habits.

- Increased Competition: Open banking fosters competition, encouraging banks to offer more innovative products and services to attract and retain customers.

4. Blockchain Technology:

- Secure and Transparent Transactions: Blockchain technology offers a secure and transparent platform for financial transactions, reducing fraud and increasing efficiency.

- Decentralized Finance (DeFi): Blockchain-based applications are enabling the development of decentralized financial services, challenging traditional banking models.

- Improved Cross-Border Payments: Blockchain can facilitate faster and more cost-effective cross-border payments, streamlining international transactions.

5. Rise of Embedded Finance:

- Integrating Finance into Everyday Life: Financial services will be seamlessly integrated into various non-financial platforms, such as e-commerce websites, ride-sharing apps, and social media platforms.

- Frictionless Transactions: Customers can make payments, access loans, and manage their finances directly within their preferred apps and platforms.

- Expanding Reach and Accessibility: Embedded finance expands access to financial services for underserved populations, promoting financial inclusion.

6. Enhanced Security and Fraud Prevention:

- Advanced Analytics and AI: Banks will utilize sophisticated analytics and AI algorithms to identify and prevent fraudulent activities, safeguarding customer accounts.

- Real-Time Fraud Detection: AI-powered systems will analyze transaction patterns and detect suspicious activities in real-time, minimizing financial losses.

- Multi-Factor Authentication: Strengthening security protocols with multi-factor authentication ensures greater protection against unauthorized access.

7. Sustainable Banking:

- ESG Investing: Banks will increasingly focus on sustainable investments, aligning their portfolios with environmental, social, and governance (ESG) principles.

- Green Finance Solutions: Banks will develop innovative financial products and services to promote green initiatives, supporting renewable energy projects and sustainable businesses.

- Carbon Footprint Reduction: Banks will strive to reduce their own carbon footprint through operational efficiency and responsible investment practices.

8. Focus on Customer Experience:

- Personalized and Intuitive Interfaces: Banking apps and websites will feature user-friendly interfaces, personalized content, and intuitive navigation.

- Digital-First Customer Service: Banks will prioritize digital channels for customer service, offering 24/7 support through chatbots, virtual assistants, and online forums.

- Data-Driven Insights: Banks will leverage customer data to personalize communication, provide tailored financial advice, and anticipate customer needs.

Related Searches

- Digital Banking Trends 2025

- Future of Banking Technology

- Banking Innovation Trends

- Financial Technology Trends

- Impact of Fintech on Banking

- Digital Transformation in Banking

- AI in Banking

- Blockchain in Banking

FAQs about Digital Trends in Banking 2025

1. What are the benefits of digital banking trends?

- Enhanced Customer Experience: Digital trends offer personalized, convenient, and efficient banking experiences.

- Improved Security: Advanced technologies like AI and blockchain enhance security and fraud prevention.

- Increased Efficiency: Automation and digitalization streamline processes, improving operational efficiency.

- Financial Inclusion: Digital solutions expand access to financial services for underserved populations.

- Sustainable Practices: Digital banking supports sustainable investments and environmental initiatives.

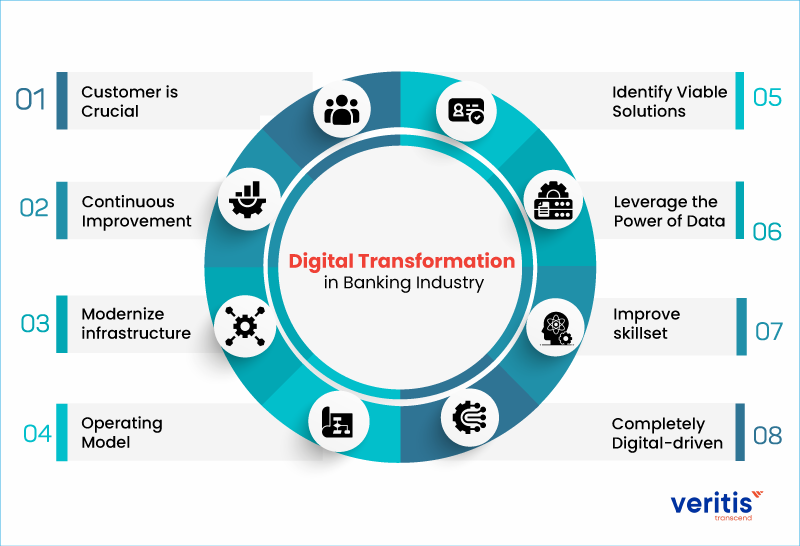

2. How will digital trends affect traditional banking?

- Increased Competition: Fintech companies and digital-first banks are challenging traditional models.

- Need for Innovation: Traditional banks must adapt and innovate to remain competitive.

- Focus on Customer Experience: Meeting evolving customer expectations is crucial for survival.

- Investment in Technology: Banks need to invest heavily in technology to stay ahead.

- Shifting Workforce Skills: New skillsets are required to manage digital technologies and customer interactions.

3. What are the challenges of implementing digital trends in banking?

- Data Security and Privacy: Protecting sensitive customer data is paramount.

- Technological Infrastructure: Investing in robust infrastructure is essential for seamless digital operations.

- Regulatory Compliance: Navigating evolving regulations and compliance requirements is crucial.

- Employee Training and Adoption: Adapting to new technologies and processes requires training and support.

- Customer Trust and Adoption: Building trust and encouraging customer adoption of digital services is vital.

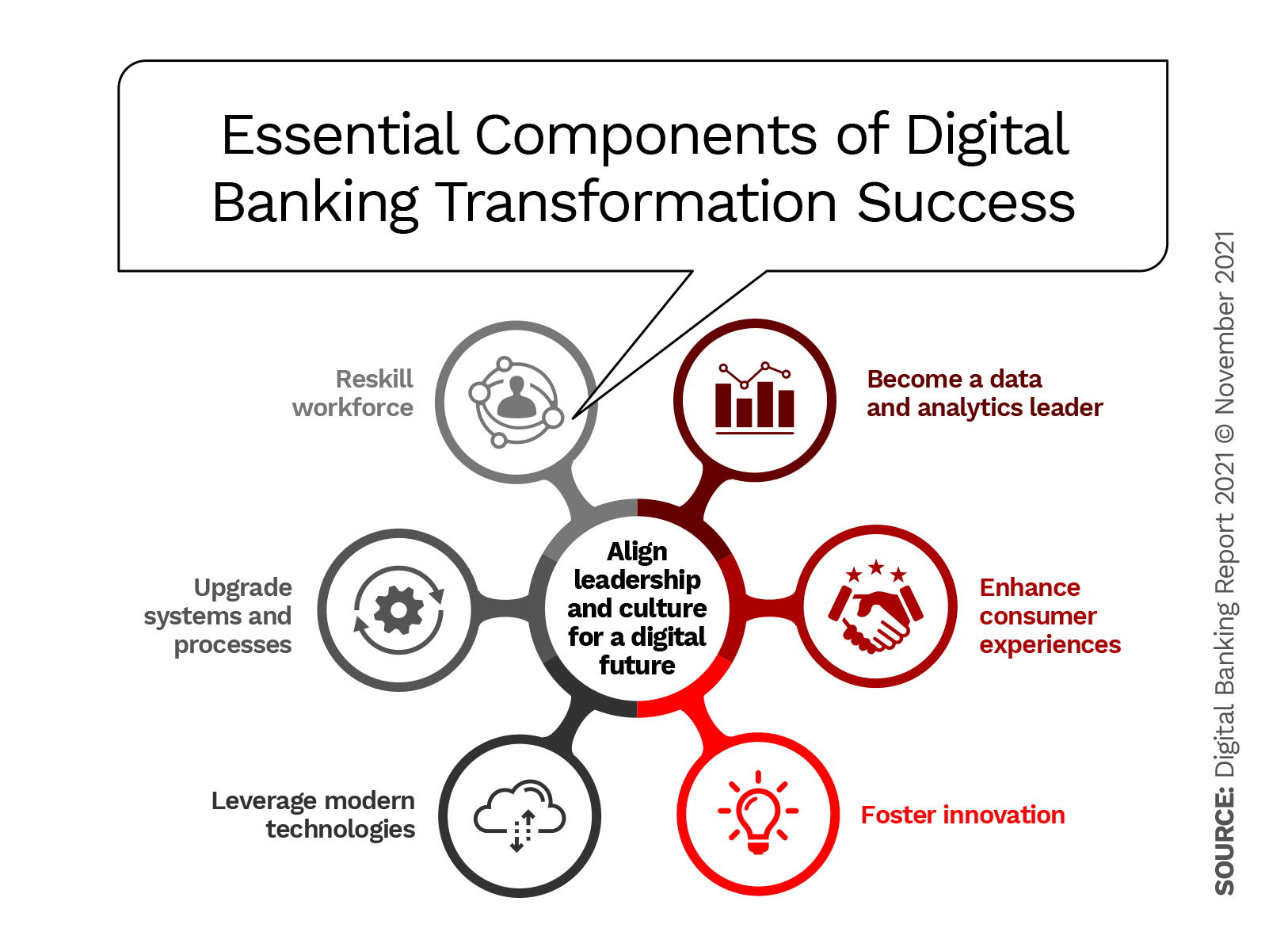

Tips for Banks Embracing Digital Trends

- Focus on Customer Needs: Prioritize understanding and meeting customer expectations.

- Invest in Technology and Innovation: Embrace new technologies and invest in R&D.

- Build a Strong Data Strategy: Leverage data to personalize services and enhance customer experience.

- Develop a Robust Cybersecurity Framework: Protect customer data and ensure secure operations.

- Embrace Collaboration and Partnerships: Collaborate with fintech companies and other stakeholders.

- Foster a Culture of Innovation: Encourage experimentation and embrace a mindset of continuous improvement.

Conclusion

Digital trends banking are transforming the industry, offering exciting opportunities for innovation and growth. By embracing these trends, banks can enhance customer experiences, improve efficiency, and stay ahead of the competition. The future of banking lies in seamlessly integrating digital solutions, fostering innovation, and prioritizing customer-centricity.

Closure

Thus, we hope this article has provided valuable insights into The Evolving Landscape of Banking: Digital Trends Shaping the Future. We appreciate your attention to our article. See you in our next article!