The Evolving Landscape: Trends Shaping the Banking Industry in 2025

Related Articles: The Evolving Landscape: Trends Shaping the Banking Industry in 2025

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to The Evolving Landscape: Trends Shaping the Banking Industry in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: The Evolving Landscape: Trends Shaping the Banking Industry in 2025

- 2 Introduction

- 3 The Evolving Landscape: Trends Shaping the Banking Industry in 2025

- 3.1 1. The Rise of Open Banking and Data-Driven Services

- 3.2 2. Embracing Artificial Intelligence (AI) and Machine Learning (ML)

- 3.3 3. The Growing Influence of Fintechs

- 3.4 4. The Rise of Embedded Finance

- 3.5 5. The Importance of Cybersecurity and Data Privacy

- 3.6 6. The Growing Demand for Personalized and Digital-First Experiences

- 3.7 7. Sustainability and ESG Investing

- 3.8 8. The Importance of Innovation and Collaboration

- 4 Related Searches:

- 5 FAQs by Trends Banking Industry 2025

- 6 Tips by Trends Banking Industry 2025

- 7 Conclusion by Trends Banking Industry 2025

- 8 Closure

The Evolving Landscape: Trends Shaping the Banking Industry in 2025

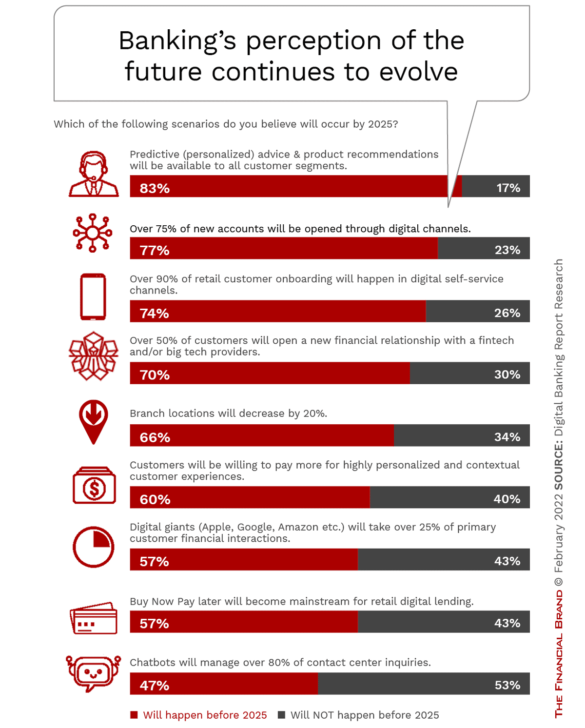

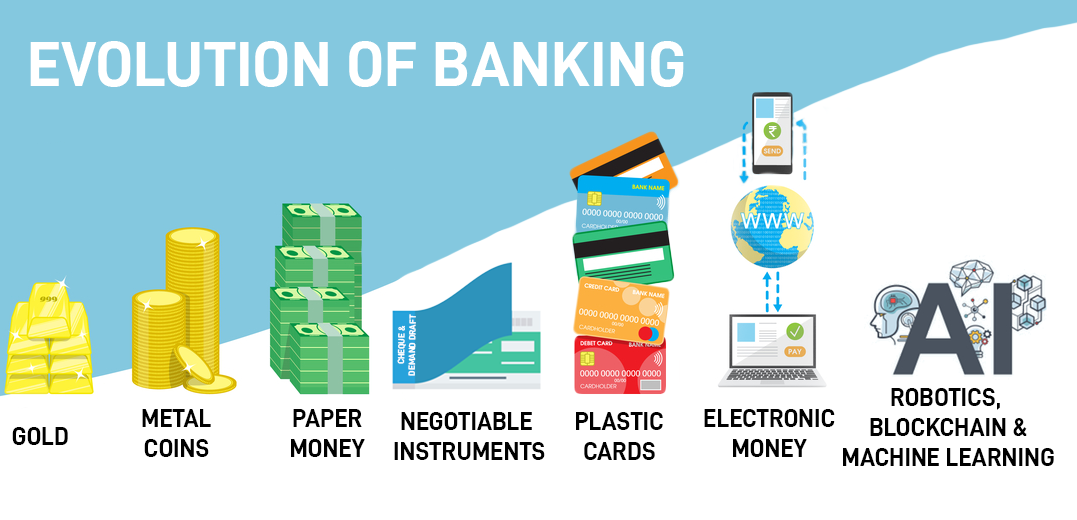

The banking industry, once a bastion of traditional practices, is undergoing a dramatic transformation. Driven by technological advancements, changing customer expectations, and evolving regulatory landscapes, trends banking industry 2025 are reshaping the way financial services are delivered and consumed. This article delves into the key trends that will define the industry’s future, offering insights into their implications and potential benefits.

1. The Rise of Open Banking and Data-Driven Services

Open banking, the sharing of customer financial data with third-party applications and services with their consent, is poised to revolutionize the industry. This trend empowers consumers by giving them greater control over their financial data and enabling them to access a wider range of personalized financial products and services.

Benefits of Open Banking:

- Enhanced Customer Experience: Consumers can access a broader range of financial products and services tailored to their specific needs.

- Increased Competition: Open banking fosters innovation and competition by allowing non-traditional players to enter the market, potentially leading to lower fees and better services.

- Improved Financial Management: Consumers can gain a more comprehensive view of their finances, making it easier to manage their money effectively.

Examples:

- Personalized financial advice: Aggregating data from various accounts, fintech apps can provide tailored financial advice, helping consumers make informed decisions about saving, investing, and spending.

- Automated bill payments: Open banking allows for seamless integration with bill payment platforms, automating payments and reducing the risk of missed deadlines.

- Credit scoring: Sharing financial data with credit scoring agencies can provide a more accurate picture of an individual’s creditworthiness, potentially leading to better loan offers.

2. Embracing Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML are transforming banking operations, enabling faster and more efficient processes, personalized customer experiences, and enhanced risk management.

Applications of AI and ML in Banking:

- Fraud Detection: AI algorithms can analyze transaction patterns and identify anomalies, helping banks detect and prevent fraudulent activities.

- Customer Service: Chatbots powered by AI can provide 24/7 customer support, answering queries and resolving issues efficiently.

- Credit Risk Assessment: AI-powered models can analyze vast amounts of data to assess creditworthiness, streamlining loan approval processes.

- Investment Management: AI-driven robo-advisors can provide automated investment advice, making wealth management accessible to a wider audience.

Benefits of AI and ML:

- Improved Efficiency: Automating repetitive tasks frees up human resources for more complex and strategic work.

- Enhanced Customer Experience: AI-powered chatbots and personalized recommendations can provide a more tailored and efficient customer experience.

- Reduced Risk: AI can help detect and mitigate financial risks, protecting banks and their customers.

3. The Growing Influence of Fintechs

Fintech companies, with their agility and focus on innovation, are challenging traditional banks in various areas. They offer specialized services, leveraging technology to create more accessible and user-friendly solutions.

Fintech Innovations:

- Mobile-first banking: Fintechs have spearheaded the shift towards mobile-first banking, providing customers with convenient and accessible financial services on their smartphones.

- Peer-to-peer (P2P) lending: Fintech platforms connect borrowers and lenders directly, bypassing traditional banks and offering more competitive interest rates.

- Micro-investing: Fintech apps make investing accessible to everyone, allowing users to invest small amounts of money in a diversified portfolio.

- Payment processing: Fintech companies have revolutionized payment processing with innovative solutions like digital wallets and mobile payment systems.

Impact of Fintechs on Traditional Banks:

- Increased Competition: Fintechs force traditional banks to innovate and adapt to stay competitive.

- New Business Models: Traditional banks are exploring partnerships and acquisitions with fintech companies to leverage their expertise and technology.

- Enhanced Customer Experience: Banks are adopting fintech solutions to improve their customer experience, offering more personalized and user-friendly services.

4. The Rise of Embedded Finance

Embedded finance involves integrating financial services into non-financial platforms, making them accessible to a wider audience.

Examples of Embedded Finance:

- E-commerce platforms: Integrating payment options and credit facilities directly into online stores.

- Ride-hailing apps: Offering micro-loans or insurance products to drivers.

- Retail chains: Providing loyalty programs with rewards points that can be redeemed for financial services.

Benefits of Embedded Finance:

- Increased Accessibility: Financial services become readily available to a wider audience, including those traditionally underserved by traditional banks.

- Enhanced Customer Experience: Customers can access financial services seamlessly within their preferred platforms, making the process more convenient.

- New Revenue Streams: Non-financial businesses can generate new revenue streams by offering financial services.

5. The Importance of Cybersecurity and Data Privacy

As banks adopt new technologies and handle increasingly sensitive data, cybersecurity and data privacy become paramount.

Cybersecurity Threats:

- Data breaches: Hackers can target banks to steal customer data, financial information, and sensitive credentials.

- Ransomware attacks: Cybercriminals can encrypt bank systems and demand ransom payments to unlock them.

- Phishing scams: Hackers can use social engineering tactics to trick customers into revealing their personal information.

Data Privacy Regulations:

- General Data Protection Regulation (GDPR) in Europe: This regulation sets strict standards for data protection and requires companies to obtain explicit consent before collecting and processing personal data.

- California Consumer Privacy Act (CCPA) in the United States: This law gives California residents greater control over their personal data and requires companies to provide transparency about data collection and usage.

Importance of Cybersecurity and Data Privacy:

- Protecting Customer Data: Banks have a responsibility to protect their customers’ sensitive data from unauthorized access and misuse.

- Maintaining Trust: Cybersecurity breaches can damage a bank’s reputation and erode customer trust.

- Compliance with Regulations: Banks must comply with data privacy regulations to avoid fines and penalties.

6. The Growing Demand for Personalized and Digital-First Experiences

Customers today expect personalized and digital-first experiences from their financial institutions. Banks need to adapt to meet these expectations by offering seamless digital experiences and personalized services.

Examples of Personalized Banking:

- AI-powered recommendations: Banks can use AI to analyze customer data and provide personalized recommendations for products and services.

- Personalized financial dashboards: Customers can access a customized overview of their finances, including spending patterns, investment performance, and loan balances.

- Chatbot support: AI-powered chatbots can provide personalized customer support, answering questions and resolving issues efficiently.

Benefits of Personalized and Digital-First Experiences:

- Increased Customer Engagement: Personalized experiences can make customers feel valued and understood, leading to increased engagement and loyalty.

- Improved Customer Satisfaction: Customers appreciate convenience and efficiency, and digital-first experiences can enhance their satisfaction.

- Competitive Advantage: Banks that offer personalized and digital-first experiences can gain a competitive advantage by attracting and retaining customers.

7. Sustainability and ESG Investing

Sustainability and Environmental, Social, and Governance (ESG) considerations are increasingly important for banks and their customers.

ESG Factors in Banking:

- Environmental Impact: Banks are under pressure to reduce their own environmental footprint and support sustainable businesses.

- Social Responsibility: Banks are expected to promote social good and address issues such as financial inclusion and diversity.

- Corporate Governance: Banks are held accountable for their ethical practices, transparency, and accountability.

Benefits of ESG Investing:

- Positive Impact: ESG investing aims to generate positive social and environmental impact alongside financial returns.

- Risk Management: ESG factors can be considered as part of a bank’s risk management strategy, identifying potential risks and opportunities.

- Attracting Investors: Investors are increasingly seeking investments aligned with their values, making ESG investing more attractive.

8. The Importance of Innovation and Collaboration

To thrive in the rapidly evolving banking landscape, banks need to embrace innovation and collaborate with partners.

Innovation in Banking:

- Emerging Technologies: Banks need to explore and adopt new technologies such as blockchain, cloud computing, and the Internet of Things (IoT) to enhance their services and stay ahead of the curve.

- New Business Models: Banks need to experiment with new business models to meet the evolving needs of their customers and adapt to changing market conditions.

- Open Innovation: Banks can benefit from collaborating with fintechs, startups, and other industry players to develop innovative solutions.

Collaboration in Banking:

- Partnerships: Banks can partner with fintechs, technology companies, and other financial institutions to leverage their expertise and resources.

- Open APIs: Banks can use open APIs to share data and services with third-party providers, enabling the development of new financial products and services.

- Joint Ventures: Banks can create joint ventures with other companies to explore new markets and expand their offerings.

Benefits of Innovation and Collaboration:

- Improved Efficiency: Collaboration can streamline processes and reduce costs.

- Enhanced Customer Experience: Joint ventures can create new products and services that meet customer needs.

- Competitive Advantage: Innovation and collaboration can help banks stay ahead of the competition and maintain their market share.

Related Searches:

1. Future of Banking: This search explores the long-term trends and predictions for the banking industry, encompassing technological advancements, regulatory changes, and evolving customer expectations.

2. Digital Banking Trends: This search focuses on the specific trends shaping the digital banking landscape, including mobile banking, online banking, and the adoption of new technologies like AI and blockchain.

3. Banking Technology Trends: This search delves into the technological advancements impacting the banking industry, such as cloud computing, big data analytics, and cybersecurity solutions.

4. Fintech Industry Trends: This search examines the latest trends in the fintech industry, including the rise of new business models, innovative financial products, and the impact of fintechs on traditional banks.

5. Banking Regulations 2025: This search explores the evolving regulatory landscape for the banking industry, including new regulations related to data privacy, cybersecurity, and financial inclusion.

6. Impact of AI on Banking: This search focuses on the specific ways AI is transforming the banking industry, including its applications in fraud detection, customer service, and risk management.

7. Open Banking Implementation: This search examines the practical aspects of implementing open banking, including the challenges and opportunities involved in sharing customer data with third-party providers.

8. Sustainable Banking Practices: This search explores the growing importance of sustainability and ESG considerations in the banking industry, including the role of banks in promoting environmental and social responsibility.

FAQs by Trends Banking Industry 2025

1. How will open banking impact traditional banks?

Open banking will force traditional banks to adapt and innovate to remain competitive. They will need to embrace new technologies, develop new business models, and offer more personalized and digital-first experiences to attract and retain customers.

2. What are the potential risks of using AI in banking?

While AI offers numerous benefits, it also presents potential risks. These include the possibility of bias in AI algorithms, the need for robust cybersecurity measures to protect sensitive data, and the potential for job displacement as AI automates tasks.

3. How can banks ensure data privacy in a digital world?

Banks must prioritize data privacy by implementing robust cybersecurity measures, complying with data privacy regulations, and obtaining explicit consent from customers before collecting and processing their personal data.

4. What are the key challenges facing the banking industry in 2025?

The banking industry faces several challenges, including increasing competition from fintechs, the need to adapt to changing customer expectations, the rising importance of cybersecurity and data privacy, and the need to embrace sustainability and ESG considerations.

5. What are the future opportunities for the banking industry?

The future of banking holds significant opportunities, including the potential to leverage new technologies to create innovative products and services, expand into new markets, and create a more inclusive and sustainable financial system.

Tips by Trends Banking Industry 2025

1. Embrace Digital Transformation: Banks must prioritize digital transformation, investing in new technologies and developing digital-first strategies to meet the evolving needs of their customers.

2. Foster Innovation: Banks should encourage a culture of innovation, experimenting with new ideas and collaborating with partners to develop innovative solutions.

3. Prioritize Customer Experience: Banks must focus on delivering a seamless and personalized customer experience, leveraging technology to provide convenient and efficient services.

4. Invest in Cybersecurity: Banks must invest in robust cybersecurity measures to protect their systems and customer data from cyberattacks.

5. Embrace Sustainability: Banks should integrate sustainability and ESG considerations into their business practices, promoting environmental and social responsibility.

Conclusion by Trends Banking Industry 2025

Trends banking industry 2025 are shaping a future where financial services are more accessible, personalized, and technology-driven. Banks must embrace these trends, adapt to changing customer expectations, and leverage new technologies to remain competitive and thrive in the evolving landscape. By prioritizing innovation, collaboration, and a focus on customer experience, banks can navigate the challenges and capitalize on the opportunities that lie ahead.

Closure

Thus, we hope this article has provided valuable insights into The Evolving Landscape: Trends Shaping the Banking Industry in 2025. We hope you find this article informative and beneficial. See you in our next article!