The Future of Finance: Exploring Fintech Trends 2025

Related Articles: The Future of Finance: Exploring Fintech Trends 2025

Introduction

With great pleasure, we will explore the intriguing topic related to The Future of Finance: Exploring Fintech Trends 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Future of Finance: Exploring Fintech Trends 2025

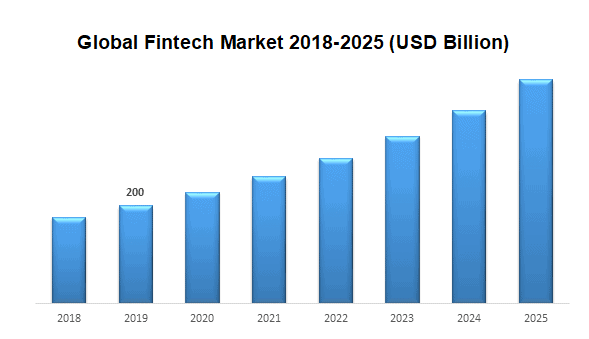

The financial landscape is constantly evolving, driven by technological advancements and changing consumer expectations. As we approach 2025, the fintech trends shaping this evolution are becoming increasingly apparent, promising a future where financial services are more accessible, personalized, and efficient than ever before. This exploration delves into the key trends driving this transformation, highlighting their potential impact on individuals, businesses, and the financial ecosystem as a whole.

1. The Rise of Embedded Finance

Embedded finance refers to the seamless integration of financial services within non-financial platforms. This trend is driven by the increasing demand for personalized and contextualized financial solutions. Consumers expect financial services to be readily available wherever they are, whether shopping online, booking travel, or managing their health.

-

Examples: A ride-hailing app offering microloans to drivers, an e-commerce platform providing instant financing for purchases, or a healthcare provider facilitating health insurance enrollment.

-

Benefits: Embedded finance empowers consumers by offering convenient access to financial services at the point of need, reducing friction and enhancing user experience. It also allows businesses to expand their offerings and generate new revenue streams by providing valuable financial services to their existing customer base.

2. The Democratization of Financial Services

Fintech trends are driving the democratization of financial services, making them accessible to a wider range of individuals and businesses, regardless of their location, income level, or credit history. This includes:

-

Financial Inclusion: Fintech solutions are bridging the gap in financial access, particularly for underserved populations in emerging markets. Mobile banking, microfinance, and peer-to-peer lending platforms are empowering individuals and communities without traditional banking access.

-

Alternative Lending: Fintech companies are developing innovative lending models, offering alternative financing options to borrowers who may not qualify for traditional loans. This includes using alternative data sources like social media activity and online behavior to assess creditworthiness.

-

Open Banking and APIs: Open banking initiatives are enabling consumers to share their financial data securely with third-party apps, fostering competition and innovation in the financial services market. This allows for personalized financial management, tailored advice, and streamlined financial processes.

3. The Power of Artificial Intelligence (AI)

AI is revolutionizing the financial industry, automating tasks, enhancing decision-making, and personalizing customer experiences.

-

Fraud Detection: AI algorithms can analyze vast datasets to identify fraudulent transactions in real-time, improving security and reducing losses for financial institutions.

-

Personalized Financial Advice: AI-powered chatbots and robo-advisors provide personalized financial advice based on individual needs and goals, making financial planning more accessible and affordable.

-

Automated Trading: AI algorithms can analyze market data and execute trades autonomously, optimizing portfolio performance and reducing human error.

4. The Evolution of Payments

Fintech trends are transforming the payments landscape, moving away from traditional methods like cash and checks towards faster, more secure, and convenient digital alternatives.

-

Mobile Payments: Mobile wallets and peer-to-peer payment platforms are gaining popularity, allowing users to send and receive money quickly and easily using their smartphones.

-

Contactless Payments: Near-field communication (NFC) technology enables contactless payments, making transactions faster and more secure.

-

Biometric Authentication: Facial recognition, fingerprint scanning, and voice authentication are enhancing security and convenience in online and offline payments.

5. The Rise of Decentralized Finance (DeFi)

Decentralized finance (DeFi) is a growing movement leveraging blockchain technology to create open and transparent financial systems.

-

Decentralized Lending and Borrowing: DeFi platforms enable peer-to-peer lending and borrowing without intermediaries, offering higher interest rates for lenders and lower borrowing costs for borrowers.

-

Decentralized Exchanges: DeFi exchanges allow for the trading of cryptocurrencies and other digital assets without the need for centralized intermediaries, providing greater transparency and control.

-

Yield Farming: DeFi platforms offer innovative ways to generate passive income by lending out digital assets and earning rewards.

6. The Integration of Blockchain Technology

Blockchain technology is disrupting the financial industry by providing a secure, transparent, and efficient platform for recording and verifying transactions.

-

Cross-border Payments: Blockchain-based platforms streamline cross-border payments, reducing costs and processing times.

-

Supply Chain Finance: Blockchain technology can track goods and payments throughout the supply chain, improving transparency and efficiency.

-

Digital Identity: Blockchain can be used to create secure and verifiable digital identities, enhancing security and streamlining financial processes.

7. The Growing Importance of Cybersecurity

As financial services become increasingly digitized, cybersecurity becomes paramount. Fintech companies are investing heavily in robust security measures to protect sensitive data and prevent cyberattacks.

-

Multi-factor Authentication: This adds an extra layer of security by requiring users to provide multiple forms of identification before accessing their accounts.

-

Encryption: Data encryption protects sensitive information from unauthorized access, even if a system is compromised.

-

Threat Intelligence: Monitoring and analyzing cyber threats to proactively identify and mitigate potential risks.

8. The Future of Financial Regulation

Fintech trends are challenging traditional financial regulations, prompting regulators to adapt and establish new frameworks to ensure a safe and fair financial ecosystem.

-

Sandboxes: Regulatory sandboxes provide a controlled environment for fintech companies to test their innovative products and services before launching them to the public.

-

Collaboration: Regulators are increasingly collaborating with fintech companies to develop effective regulatory frameworks that balance innovation with consumer protection.

-

Data Privacy: Regulators are focusing on data privacy and security, ensuring that consumer data is protected and used responsibly.

Related Searches

The rapidly evolving nature of fintech trends leads to a multitude of related searches, providing further insights into the future of finance:

-

Fintech Investment Trends: Investors are increasingly allocating capital to fintech startups and established companies, recognizing the potential for high returns and disruptive innovation.

-

Fintech Startups: The fintech ecosystem is thriving with numerous startups developing innovative solutions across various financial sectors, from payments and lending to insurance and wealth management.

-

Future of Banking: Traditional banks are facing growing competition from fintech companies and are adapting their strategies to leverage technology and provide more personalized and digital-centric services.

-

Impact of Fintech on the Economy: Fintech is transforming the global economy, creating new jobs, improving financial access, and driving economic growth.

-

Fintech Regulation: Regulatory frameworks are evolving to keep pace with the rapid advancements in fintech, balancing innovation with consumer protection and financial stability.

-

Fintech in Developing Markets: Fintech solutions are playing a crucial role in driving financial inclusion and economic development in emerging markets.

-

Fintech Trends 2024: Analyzing the current trends and predicting the future trajectory of fintech in the short term, providing insights into emerging technologies and market dynamics.

-

Fintech Trends 2026: Looking further ahead, exploring the potential impact of long-term trends and technological advancements on the future of finance.

FAQs

1. What are the biggest challenges facing fintech in 2025?

-

Regulation: Navigating the evolving regulatory landscape can be challenging for fintech companies, requiring them to comply with new rules and regulations.

-

Security: Protecting sensitive data and preventing cyberattacks is a major challenge, particularly as financial services become increasingly digitized.

-

Competition: The fintech market is highly competitive, with numerous players vying for market share and customer loyalty.

-

Consumer Trust: Building trust with consumers is essential for fintech companies, especially as they handle sensitive financial information.

2. How will fintech impact traditional financial institutions?

Fintech companies are disrupting the traditional financial services market, forcing banks and other institutions to adapt and innovate to remain competitive. This includes:

-

Adopting new technologies: Traditional institutions are investing in digital technologies to improve their services and compete with fintech players.

-

Partnering with fintech companies: Collaboration with fintech startups can provide access to innovative technologies and solutions.

-

Developing new business models: Traditional institutions are exploring new business models to cater to the changing needs of consumers and businesses.

3. What are the potential benefits of fintech for consumers?

Fintech offers numerous benefits for consumers, including:

-

Increased access to financial services: Fintech solutions are making financial services more accessible to a wider range of individuals, particularly those who were previously underserved.

-

Lower costs: Fintech companies can offer lower fees and interest rates than traditional financial institutions, making financial services more affordable.

-

Improved convenience: Fintech solutions are making financial transactions and management more convenient and efficient.

-

Personalized experiences: Fintech companies can tailor their services to meet individual needs and preferences, providing a more personalized experience.

4. How can businesses benefit from fintech?

Fintech can provide numerous benefits for businesses, including:

-

Improved efficiency: Fintech solutions can automate financial processes, reducing manual tasks and improving efficiency.

-

Reduced costs: Fintech can help businesses save money on financial services like payments, lending, and accounting.

-

Enhanced customer experience: Fintech solutions can improve customer service and provide a more personalized experience.

-

Access to new markets: Fintech can enable businesses to expand into new markets and reach a wider customer base.

Tips for Navigating the Fintech Trends of 2025

-

Embrace innovation: Stay informed about the latest fintech trends and be open to adopting new technologies and solutions.

-

Focus on customer experience: Provide personalized and seamless experiences that meet the evolving needs of customers.

-

Prioritize cybersecurity: Invest in robust security measures to protect sensitive data and prevent cyberattacks.

-

Build strong partnerships: Collaborate with other fintech companies and traditional financial institutions to leverage complementary strengths.

-

Embrace regulation: Stay informed about regulatory changes and ensure compliance with evolving rules and regulations.

Conclusion

The fintech trends shaping the financial landscape in 2025 are creating a future where financial services are more accessible, personalized, and efficient than ever before. From embedded finance and the democratization of financial services to the transformative power of AI and blockchain technology, these trends are driving innovation and reshaping the way we manage our finances. By embracing these trends, individuals, businesses, and financial institutions can unlock new opportunities and navigate the evolving financial ecosystem.

![The Future Is Fintech [Infographic]](http://infographicjournal.com/wp-content/uploads/2017/04/Fintech-snip-1024x483.jpg)

![Top 5 Current Fintech Trends [2022 - 2025]](https://assets.website-files.com/61b6d36e8f52d840c65c7d07/64ce86a1dc71cc8c7327e895_Top%205%20fitech%20trends.png)

Closure

Thus, we hope this article has provided valuable insights into The Future of Finance: Exploring Fintech Trends 2025. We thank you for taking the time to read this article. See you in our next article!